Advertisement

Advertisement

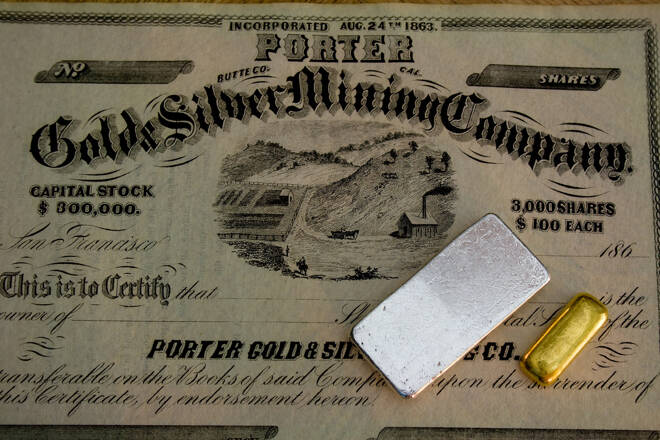

Gold Price Forecast – Gold Markets Trying to Find Footing

Updated: Aug 10, 2021, 16:18 GMT+00:00

Gold markets are doing very little during the trading session on Tuesday as the market is more likely than not awaiting the CPI numbers on Wednesday.

Gold markets have gone back and forth during the trading session on Tuesday as we are dancing around the $1725 level. At this point, it looks as if the market is trying to figure out what to do about inflation, as interest rates in the United States rising continue to work against gold in general. With that being the case, it makes a certain amount of sense that we would see trouble for the markets short term, perhaps culminating and whatever comes out of the CPI announcement, as it will give us the next look at what is going on inflation wise in the United States.

Gold Price Predictions Video 11.08.21

As market participants continue to anticipate higher interest rates coming out of America, it drives up the value of the US dollar which of course works against the value of gold, because it is priced in that same currency. Furthermore, you also have to keep in mind that it is much cheaper to hold the piece of paper than it is to store gold, which also works against the value of an asset that pays no yield. With that being the case, I think that we are going to continue to see selling short-term rallies and a recognition of the $1750 level as an area that is going to be difficult to break above.

If we break down towards the $1680 level, then it is very possible that we break down towards the $1500 level quite rapidly, because I see a huge “air pocket” underneath there. To the upside, if we were to take out the 1750$ level after the CPI figures, then the next target would be the $1800 level.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement