Advertisement

Advertisement

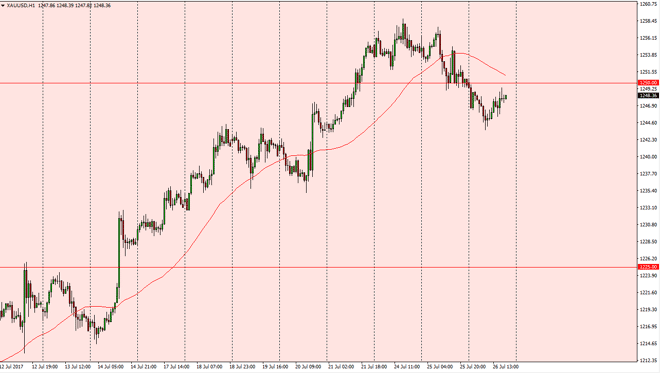

Gold Price Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:41 GMT+00:00

Gold markets drifted a little bit lower pre-FOMC on Wednesday, as we continue to bounce around the $1250 level. Ultimately, it looks as if the gold

Gold markets drifted a little bit lower pre-FOMC on Wednesday, as we continue to bounce around the $1250 level. Ultimately, it looks as if the gold markets are getting ready make a $50 decision, as we are in the middle of massive consolidation. At the lower end of the consolidation is the $1200 support level, and at the higher end of consolidation is the $1300 level. I think that a move that holds either a $10 game, or a $10 loss from the $1250 level is your signal. In other words, if we can break above the $1260 level, the market should then go to the $1300 level. Alternately, if we break down below the $1240 level, the market will probably go to the $1200 level. A lot of this is going to come down to how the market anticipates and interprets the FOMC announcement.

Volatility, but clarity is coming.

I believe that it is going to be choppy, but clarity is coming given enough time. I think that once we do move significantly, then it shows where we are going to go next. Once we get that break out or breakdown, I’m willing to jump into the market, even with leverage and start playing towards the outer reaches of the consolidation. I think that if we start reaching towards the $1300 level, the market will probably continue beyond their, but it may take several attempts to finally break out of the consolidation. If we break down below the $1200 level, that would be catastrophic and probably send this market down towards the $1150 level, perhaps even down to the $1100 level after that. All things being equal, I believe gold continues to have a bit of a bid underneath that though, so I lean towards being a buyer.

Gold Price Forecast Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement