Advertisement

Advertisement

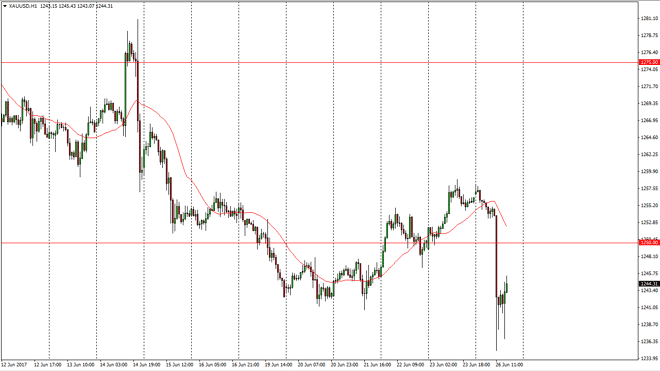

Gold Price Forecast June 27, 2017, Technical Analysis

Updated: Jun 27, 2017, 06:52 GMT+00:00

Gold markets fell rather significantly during the day on Monday, slicing through the $1250 level, and then the $1240 level. The market turned around

Gold markets fell rather significantly during the day on Monday, slicing through the $1250 level, and then the $1240 level. The market turned around though, and it looks as if it is trying to find some type of support in this general vicinity. Because of this, the market looks very likely to continue to find buyers in this general vicinity, but if we were to break down below the lows of the last couple of days, that could be a very negative sign, perhaps looking at $1200 as the next level. Ultimately, the market should continue to remain volatile, and with all the several central bankers speaking during the day, we could find plenty of catalysts to move the gold market.

The US dollar

Obviously, the US dollar has a lot of say when it comes to the gold markets, so if we get a massive move in the US dollar, gold typically has an inverse correlation. There’s also the “fear factor” when it comes to trading gold, so geopolitical headlines get out of control, it’s likely that gold will rally. A break above the $1258 level should send this market much higher, perhaps reaching as high as the $1275 level. That’s an area that is massively resistive, and with this being the case it’s likely that the breaking of that area would send a lot of money into this market. I believe the gold will remain volatile, and most certainly will be during the day today, with so many potential headlines crossing the wires due to the central bank speakers. I believe that the market is probably best treated in very small increments, as the volatility could get you hurt rather quickly. By adding to existing positions that are already profitable, you can then build up a larger holding.

Gold Price Video 27.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement