Advertisement

Advertisement

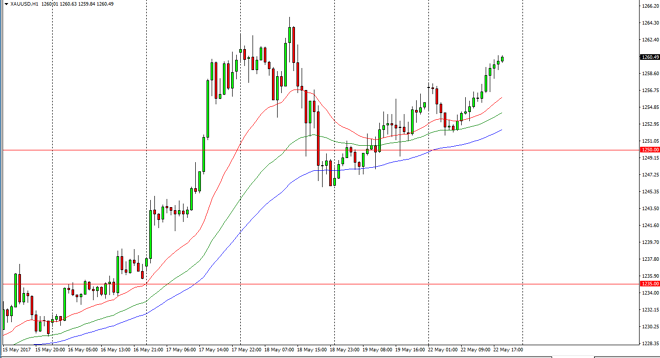

Gold Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:06 GMT+00:00

Gold markets initially gapped higher at the open on Monday, but then pulled back significantly to test the 48 hour moving average line. We bounce from

Gold markets initially gapped higher at the open on Monday, but then pulled back significantly to test the 48 hour moving average line. We bounce from there, and have since made a fresh high for the session at the $1260 level. I believe that there is a lot of noise in this area, so a pullback makes quite a bit of sense. Ultimately though, I think the pullback will be supported, especially considering how many things out there could have traders jumping right back into gold. We have enjoyed a bit of a bid from the “safety trade” recently, and that should continue to be the case. I think that the $1250 level below will act as a “floor” in a market that obviously looks well supported. With all of the major issues going on around the world currently, not the least of which would be North Korea, it makes sense the traders will continue to pick up a little bit of gold here and there to protect themselves.

Buying dips

I believe that the moving average is on the chart, the 24, 48, and 72 hour moving averages will continue to play an important role in this market, and therefore should act as dynamic support. Buying dips down to those moving averages is how I’m planning on building a larger position. Once we break above the $1265 level, I think that the market is free to go to the $1280 level, and then eventually the $1300 level. Longer-term, I remain bullish of gold, but recognize from time to time we may have sharp selloffs. That’s the nature of the market when it is trading on the fear trade, so you must be aware of this before you put any money to work.

Gold Price Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement