Advertisement

Advertisement

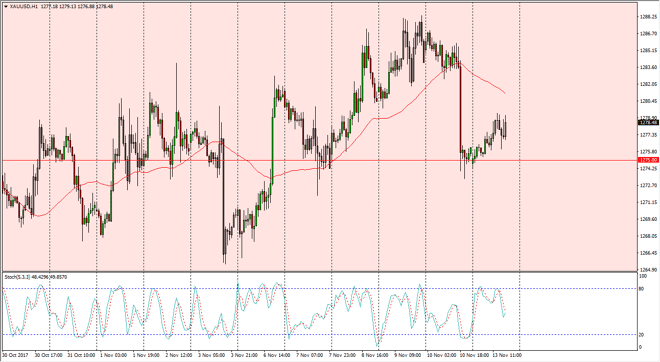

Gold Price Forecast November 14, 2017, Technical Analysis

Updated: Nov 14, 2017, 04:43 GMT+00:00

The gold markets rallied a bit during the trading session on Monday, using the $1275 level as support. This is an area that has been “fair value” as of

The gold markets rallied a bit during the trading session on Monday, using the $1275 level as support. This is an area that has been “fair value” as of late, and because of this it’s not hard to imagine that there would’ve been some interest in the market at that level. I suspect that the $1290 level above will continue to be resistive, just as the $1265 level underneath will be supportive. In the meantime, every time we get a bit too far from the $1275 level, the market looks ready to return to that level. However, I think in the short term we will continue to see a bit of bullish pressure, perhaps for the next $7 or so. If you are short-term trader, it’s likely that you will be able to take advantage of this. Alternately, if we were to break down below the $1272 level, the market will probably drop towards the $1265 level.

Pay attention to the US dollar, as it has massive influence on the goal market, but we also must be concerned about the overall geopolitical attitude around the world, as gold can be used as a bit of a haven during times of instability. This is normally a short-term situation, but in general for the short-term trader they can take advantage of headlines coming out of places like North Korea to make profits. In the short term, I don’t see the reason we don’t continue to go higher, and I think that the buyers will prevail. However, there is no reason to think that we are going to break out and make some type of major surge towards the $1300 level, barring some type of noise coming out of Washington DC involving the tax reform bill failing.

Gold Analysis Video 14.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement