Advertisement

Advertisement

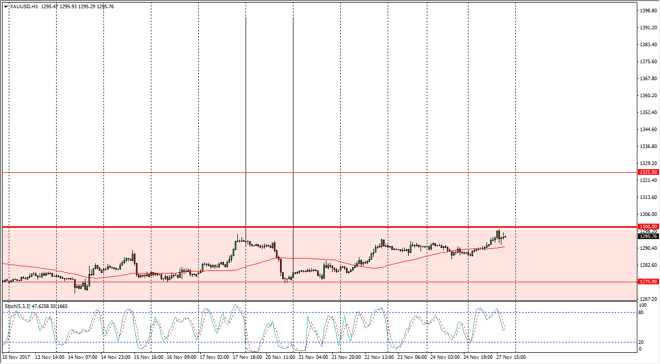

Gold Price Forecast November 28, 2017, Technical Analysis

Updated: Nov 28, 2017, 05:26 GMT+00:00

Gold markets drifted a bit higher during the day on Monday, as the US dollar was beaten up a little bit. However, the $1300 level offered enough

Gold markets drifted a bit higher during the day on Monday, as the US dollar was beaten up a little bit. However, the $1300 level offered enough resistance to keep the market somewhat flat, so I think that the market isn’t ready to break out yet. In fact, I suspect that we will get some type a pullback, and then perhaps bullish pressure again. If we do break above the $1300 level for any real length of time, we will probably go looking towards the $1325 level above, which has been very resistive. I think this market will continue to react to the US dollar in general, and by extension what the US Congress is doing, or perhaps in this case – not doing.

If we were to break above the $1325 level, the gold market could go much higher. I think that this is a story for 2018 though, and in the meantime, it’s likely that we continue to see a lot of volatility, without much in the way of movement. If we pull back from here, we could go as low as the $1275 level underneath, and then eventually the $1250 level after that. I suspect that this is purely an anti-US dollar play, and that there isn’t much going on in this market besides that. With so many support and resistance levels in such a short amount of real estate, it’s hard to imagine that plane this market for anything more than a scalp is feasible, unless of course you are a buy-and-hold type of traitor, and using physical metals to do so. I do favor the upside in general, but I recognize that we are not ready to go higher in current conditions, as it just hasn’t been enough of a catalyst.

Gold Price Video 28.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement