Advertisement

Advertisement

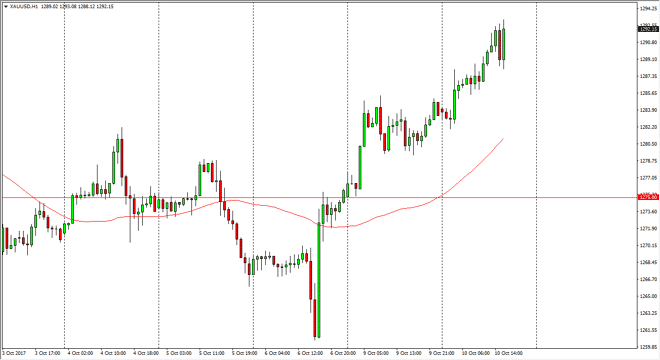

Gold Price Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:26 GMT+00:00

Gold markets rallied during the day on Tuesday, reaching towards the $1290 level. At this point, looks as if gold is going to continue to go higher,

Gold markets rallied during the day on Tuesday, reaching towards the $1290 level. At this point, looks as if gold is going to continue to go higher, perhaps reaching towards the $1300 level above, which is a large, round, psychologically significant number. It’s an area that markets have reacted to more than once, and was initially the scene of a major breakout. However, the market should continue to go towards the upside, due to the weekly hammer that formed. I believe that a break above the $1300 level should send this market towards the $1325 level after that. I also recognize the $1275 level as a bit of a floor now, and I think that the market should continue to be choppy, but certainly seems to have a bit of a significant support barrier underneath.

Risk appetite

Keep in mind that there is a lot of risk appetite involved in the gold markets, and that being said it’s likely that we will continue to see geopolitical concerns come into this market place, and sent gold higher. We have potential flashpoints at several places currently, including North Korea, Syria, Spain, and of course Turkey. With all of this out there, it’s likely that we will continue to see a lot of interest. Beyond that, we have the FOMC Meeting Minutes coming out during the day, and it means that the gold markets could be extraordinarily volatile during the session as well. After all, the hawkishness of the FOMC will drive where the US dollar goes, and quite often that will work inversely to the value of gold. With this in mind, expect a lot of volatility, but I still believe that we have buyers underneath willing to take advantage of this recent pullback based upon technicals.

Price of Gold Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement