Advertisement

Advertisement

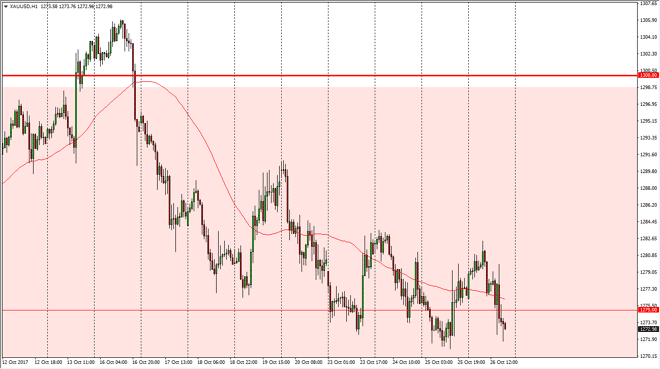

Gold Price Forecast October 27, 2017, Technical Analysis

Updated: Oct 27, 2017, 05:03 GMT+00:00

Gold markets initially tried to rally during the day on Thursday, but then rolled over to break through the $1275 level again. It looks as if a move below

Gold markets initially tried to rally during the day on Thursday, but then rolled over to break through the $1275 level again. It looks as if a move below the $1270 level should be an opportunity to start falling, perhaps reaching down to the $1250 level. That level is the midpoint of the overall consolidation, and I think we will probably go looking for that area sooner rather than later. With the US dollar strengthening overall, that continues to weigh upon the gold markets, as the Federal Reserve looks likely to raise interest rates. With this being the case, it’s likely that we will see gold markets fall apart and drop rather rapidly. I think the rallies are selling opportunities, especially near the $1280 level. If we did break above that handle, then the market might be able to go to the $1300 level above, but right now it appears that we are building bearish pressure.

Selling short-term rallies will be the way going forward, and exhaustive candles will be used to start going short, and I think that the $1250 level will be settled upon as the overall “fair value” in the longer-term charts just as it was previously. The break above the $1300 level now looks as if it was a bit of a “false breakout”, and that means that the market is probably ready to go back and forth as it had been for some time. Ultimately, I think that this is a market that is appealing for short-term traders only, longer-term traders can have a lot of problems getting clarity in a market that clearly is erratic to say the least. I believe that most of the movement in this market will be due to US dollar and Federal Reserve expectations.

Gold Price Predictions Video 27.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement