Advertisement

Advertisement

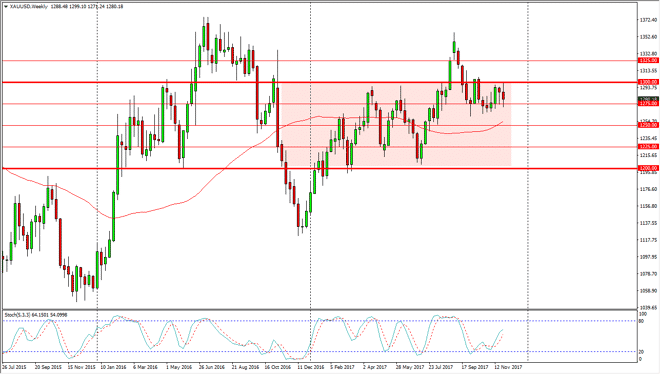

Gold Price forecast for the week of December 4, 2017, Technical Analysis

Updated: Dec 2, 2017, 07:43 GMT+00:00

Gold markets went back and forth during the week, testing the vinyl $1300 level, but pulling back from there. We remain stuck between the $1275 level and the $1300 level, so it’s important to look at the range bound aspects of this market.

When I look at gold, I recognize that we are currently in a very tight $25 range, so it’s difficult to get overly excited about a longer-term position. I think that the market will eventually break out, but in the meantime, it’s likely that the lack of liquidity during the holiday trading will probably going to be difficult to overcome, and I think that the market will be one that is probably best traded with physical gold more than anything else. Leverage is probably going to cause issues, so I prefer a much more benign type of investment. However, if we were to break above the $1300 level this market would break out to the upside and go towards $1325 level next and with rather few issues. Alternately, if we break down below the $1275 level, I think the market goes down to the $1250 level, which is the middle of the overall consolidation area that we spent most of 2017 in.

Longer-term, I do believe the gold rallies against the US dollar, but this is more of a longer-term and multi-year story than anything else, and that’s why a like buying the physical metal and holding onto it, because then you take the issues of leverage out of the picture, and can handle the swings of volatility. If you don’t have the ability to buy physical gold and try small CFD positions to the upside. Don’t over lever yourself though, keep your trading capital fluid enough to take advantage of more momentum driven markets.

Gold Technical Analysis Video 04.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement