Advertisement

Advertisement

Gold Price forecast for the week of January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:56 GMT+00:00

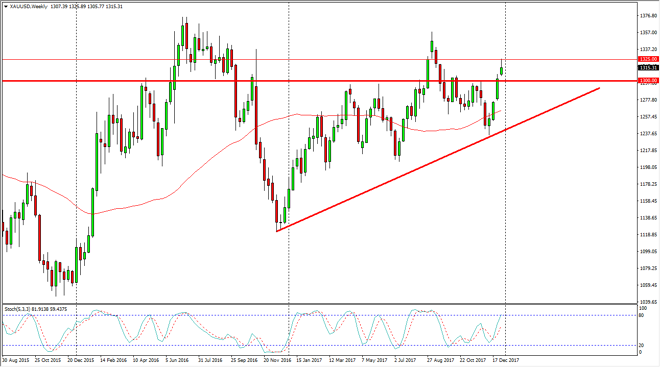

Gold markets gapped higher at the open during the week, reaching towards the $1325 level. That’s an area that has offered a significant amount of resistance though, as we have seen the market pull back from there. Ultimately though, I think if we can break above the $1325 level, the market goes looking towards the $1350 level, perhaps even higher than that.

Gold markets rallied significantly during the week, capping above the $1300 level. I believe that the market is eventually going to reach towards the $1325 level, breaking above there, and then going much higher. If we were to break down below the $1300 level, that is a sign that we may not be able to continue to go higher. Ultimately, the markets will remain very volatile, the gold markets reacting to the anti-US dollar sentiment. I think given enough time, we will not only reach towards the $1400 level above, but go much higher. The uptrend line has been reliable so far, so even if we were to break down below the $1300 level, I think there is plenty of support near the $1250 level. In other words, I have no interest in shorting gold long-term, and I think that any weakness should be thought of as a buying opportunity, but you will need to be very patient underneath $1300, and perhaps use no leverage. Under there, I would prefer to buy physical gold, but between now and then, I think you can take small leverage to positions, adding to what you already have.

The markets will of course continue to react to the US dollar, but my technical analysis suggests that the year is going to be very tough on the US dollar, so I think the gold will react positively as a result.

Gold Price Predictions Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement