Advertisement

Advertisement

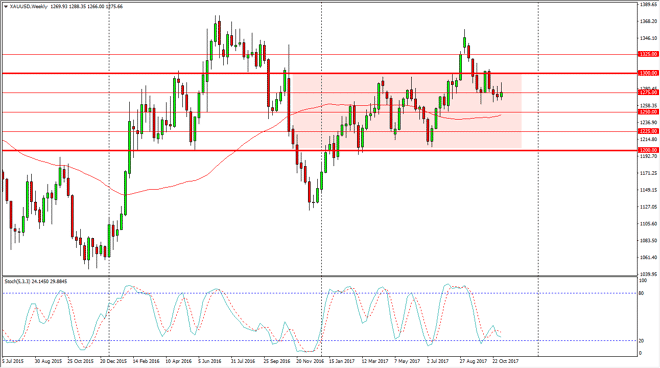

Gold Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:11 GMT+00:00

Gold markets initially tried to rally during the week, but turned around to form a shooting star. This of course is a negative sign, especially

Gold markets initially tried to rally during the week, but turned around to form a shooting star. This of course is a negative sign, especially considering that the previous candle was a shooting star. I believe that a breakdown below the bottom of the candle for the week should send this market looking for support below, closer to the $1250 level. That is the middle of the overall consolidation area that we had been in previously, and that could of course attract a lot of attention. Alternately, if we were to break above the $1300 level, that is a very strong buying opportunity based upon momentum and the break out. I think that the $1325 level should of course be resistance, based upon the reaction that we had seen. However, a break above there census market the much higher levels, and I think that gold is eventually going to find an of buying pressure to go higher. Looking at this chart, we have a nice uptrend in channel from what I can see, going back to the beginning of the year. That being said, I do think that eventually we get a rally.

One of my favorite ways to trade gold is to build up a physical position. However, if you don’t have that opportunity you should look towards the CFD market as it gives you an opportunity to build a position slowly, and dial back some of the leverage in the meantime as we have so much in the way of volatility. In general, I do like buying gold for the longer-term move, but in the short term it could be rather painful to hang onto a large position. Overall, this is a market that should perform well, but obviously we have a lot of work to do.

Gold Technical Analysis Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement