Advertisement

Advertisement

Important CHF Pairs: Technical Outlook

By:

USD/CHF USDCHF is presently trading around the 0.9635-30 support-confluence, including short-term ascending trend-line and 23.6% Fibonacci Retracement of

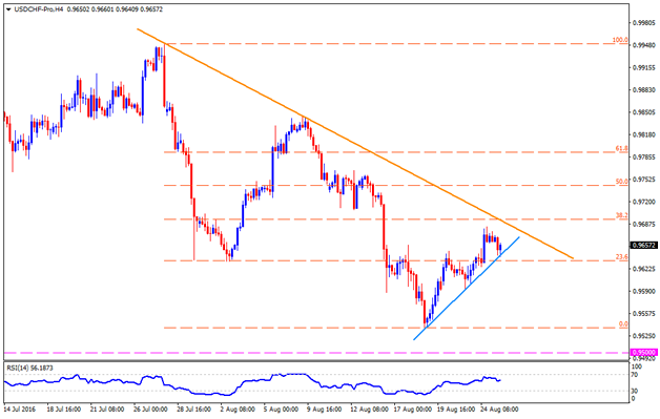

USD/CHF

USDCHF is presently trading around the 0.9635-30 support-confluence, including short-term ascending trend-line and 23.6% Fibonacci Retracement of its July – August drop. With the RSI reversing from overbought region, the pair is more likely to dip below 0.9630 and test the 0.9590 and the 0.9570 supports prior to revisiting the early month lows of 0.9537. However, its further downside below 0.9537 might find it difficult to clear 0.9500 round figure mark, comprising April month lows, which if broken can quickly drag the prices to 0.9450-45 area. On the upside, 0.9670 can entertain immediate buyers prior to the pair’s run towards 0.9695 – 0.9700 region, including 38.2% Fibo and a month-old downward slanting TL. Given the pair surpasses 0.9700 mark, it becomes capable enough to print 0.9760 and the 0.9790, at the 61.8% Fibo, on the chart.

EUR/CHF

Even if the EURCHF managed to bounce from 1.0830-25 area, the pair’s current up-move may stall around 1.0910-15 region, including a downward slanting trend-line stretched since July and 50% Fibonacci Retracement of its February – June drop. If at all the pair clears the 1.0915, the 200-day SMA level of 1.0925 becomes a tough nut to crack, breaking which chances of its rally to 1.0950 and the 61.8% Fibo level of 1.0980 become brighter. Alternatively, 1.0860, followed by the 1.0840-35 area, including nearby ascending TL and 38.2% Fibo, can continue limiting the pair’s downside. Should the pair declines below 1.0835, the 1.0815, 1.0790 and the 1.0770 are likely consecutive southward stats that it could print ahead of flashing 1.0715 support level.

GBP/CHF

With a month old descending trend-line again restricting GBPCHF upside, the pair signal brighter chances of a dip to 1.2675 and the 1.2650 supports. If the pair continue declining below 1.2650, 23.6% Fibonacci Retracement of its July – August drop, at 1.2625 and the 1.2570 can halt the pair’s further south-run, which if not respected can drag it to 1.2500 and the recent lows of 1.2450. Meanwhile, 1.2785 and the 1.2820-25 area, encompassing the mentioned TL and 50% Fibo, can act as nearby resistance to watch, breaking which 1.2850 and 1.2880 can be witnessed. Moreover, pair’s additional advances beyond 1.2880, may open the door for its run-up to 1.2920 and the 1.2990 north-side important figures.

CHF/JPY

A month old descending trend-line, at 104.20, is likely a drag that can halt the CHFJPY’s recent pullback, failing to which can trigger the pair’s advances to 104.50 and 61.8% Fibonacci Retracement of July month rally, at 104.70. During the pair’s additional rise beyond 104.70, the 105.15-20 and the 106.00 are likely figures that it can aim for. On the contrary, pair’s reversal can show 103.70-65 prior to testing the 103.20-25 horizontal support, breaking which 102.80 might act as a small barrier, clearing which it could revisit the July month lows of 102.00 round figure mark.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement