Advertisement

Advertisement

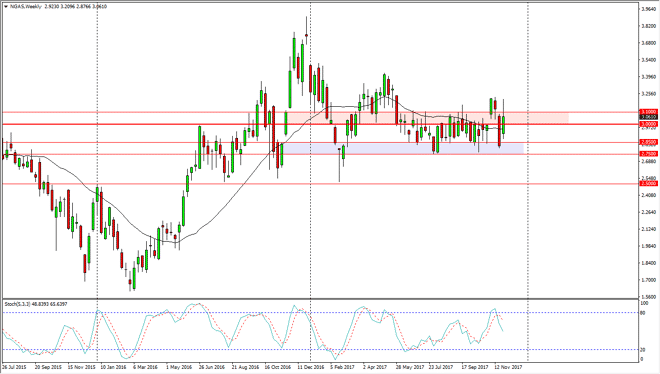

Natural Gas forecast for the week of December 4, 2017, Technical Analysis

Updated: Dec 2, 2017, 07:43 GMT+00:00

Natural gas markets continue to chop around, and even with all the noise that we have seen, one thing remains clear: we are still in a consolidated market.

Natural gas markets had an extraordinarily bullish move initially during the week, but struggled at the $3.20 level again, only to roll around and form a bit of a shooting star looking candle in the middle of overall consolidation. Essentially, the way am looking at this market is is reacting to whether forecasts in the northeastern part of the United States for the next week. Because of this, it is almost impossible to trade this market from a longer-term perspective, unless of course you are looking to sell in an area that could be thought of as overbought. That’s essentially what happened during the week, but longer-term traders will have missed that trade, as these moves are coming too quickly. However, the longer-term bearishness of this market should continue, because quite frankly we have far too much in the way of oversupply to keep natural gas markets elevated for anything more than a seasonal play over the next couple of weeks.

I believe that the $2.75 level is massively supportive though, but a breakdown below there should send the market to the $2.50 level word is even more supportive. If we can break above the Over the last couple of weeks, it could be the move higher that we tend to get towards the end of the year, but that’s a short-term phenomenon, as by the time the middle of January comes into play, we will often see sellers come back in and pushing lower. We have far too much natural gas out there to think that rallies will be sustainable for more than the occasional pop in pricing.

NATGAS Video 04.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement