Advertisement

Advertisement

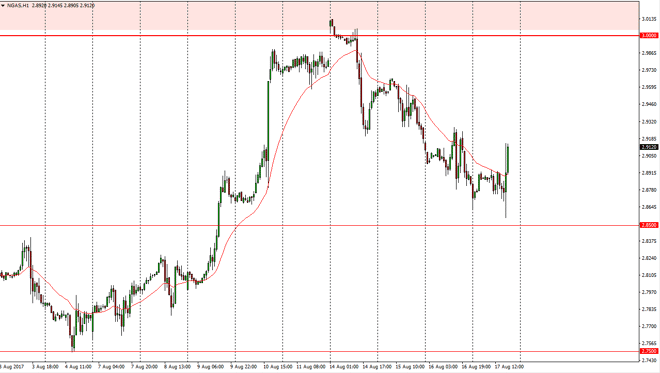

Natural Gas Price Forecast August 18, 2017, Technical Analysis

Updated: Aug 18, 2017, 05:32 GMT+00:00

Natural gas markets went sideways for most of the session during the Thursday trading hours, and then dipped towards the $2.85 level. We have broken out

Natural gas markets went sideways for most of the session during the Thursday trading hours, and then dipped towards the $2.85 level. We have broken out to the upside, but quite frankly this should into being and I selling opportunity. The market tends to run into serious trouble every time we get close to the $3.00 level, and to be honest with you I would be a bit shocked if we got that high. I’m looking for any signs of weakness to start shorting, as I believe that we will eventually build up enough pressure to break down below the $2.85 level. After that, the market should then go to the $2.75 level, which is the next major support barrier. Given enough time, I think that the sellers will return, because quite frankly we are far oversupplied and natural gas, and it would take something major to change things.

Volatility

Keep in mind that summertime trading in the futures market tends to be a little bit light. This is especially true natural gas, because it is a bit thinner market than some of the other ones. With this, the exacerbated moves happen, but quite frankly it’s a nice way to profit if you have a discernible trend, which we most certainly do on the longer-term charts. We also have a very discernible resistance barrier that the market should not be able to get above. Because of this, I remain very bearish of this market, and look at these moves as an opportunity to get involved yet again. I don’t know if we can break below the $2.85 level the short-term, but I do think it happens longer term. This bounce may just be another opportunity to build up enough momentum to finally do so.

NATGAS Video 18.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement