Advertisement

Advertisement

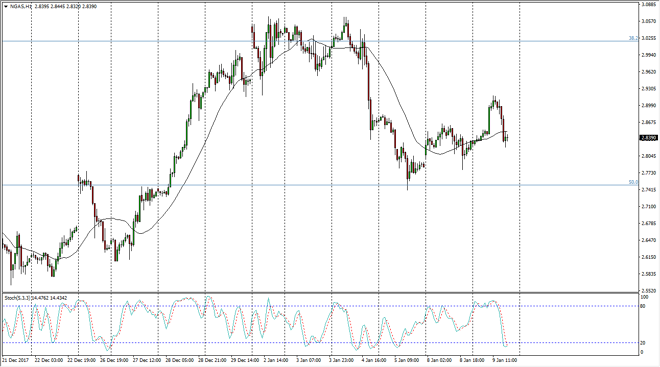

Natural Gas Price Forecast January 10, 2018, Technical Analysis

Updated: Jan 10, 2018, 04:11 GMT+00:00

Natural gas markets initially rally during the trading session on Tuesday, but found enough resistance near the $2.92 level to roll things over and form a negative daily candle. At this point, I think the market is trying to find more support, but longer-term we obviously have major issues.

The natural gas markets initially tried to rally during the trading session on Tuesday, but found enough resistance above the turn things around and fall again. We have found support near the $2.82 level, but this is minor to say the least. I think that the longer-term outlook for this market should continue to be negative, as we have more than enough supply in the marketplace to keep price down longer term. After all, we are in the most bullish time of the year, and we can’t keep gains for any substantial length of time. If that’s the case, as soon as temperatures warm up in the United States, it’s a most impossible to imagine a scenario where price goes higher. I look at rallies as selling opportunities, and certainly most traders did during the day on Tuesday. Think of it as offering value in the US dollar, which is a bit counterintuitive but at the end of the day you should keep in mind that the commodity is priced in US dollars, so there is a little bit of an inverse correlation.

I think that the $2.75 level is rather supportive, so it will take a significant amount of momentum to break down below there. However, I believe there’s no way to consider rallies with any significant money, so I feel that is just going to be easier to short this market and patiently wait for opportunities to give a signal that the market has gotten a bit too expensive, especially near the $3 handle.

NATGAS Video 10.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement