Advertisement

Advertisement

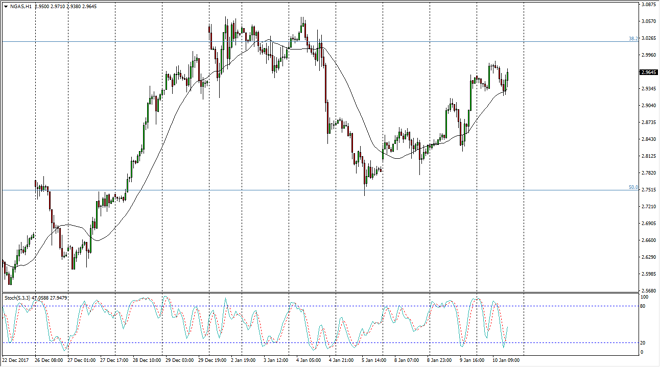

Natural Gas Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:15 GMT+00:00

Natural gas markets went sideways initially during the trading session on Wednesday, as the $3 level above looms large. That’s an area where we would expect to see a lot of selling pressure, and therefore I’m looking for some type of exhaustion to take advantage of.

Natural gas markets rallied a bit during the day after going back and forth on Wednesday, suggesting that we will test the $3 handle. That area of course will have a significant amount of interest around it, as it is a large, round, psychologically significant number. The market looks likely to see a lot of noise overall, as the time of year tends to be very volatile. This, year is typically positive for natural gas, as color temperatures reach towards the larger population centers of America. However, we have not been able to keep these gains for any length of time, so I believe that this will end up being a nice selling opportunity, perhaps sending the market back down to the $2.75 level again, an area that we have been at just a few days ago.

If we did break out to the upside, the $3.10 level is probably even more resistive. The markets will continue to be very noisy, but I do recognize that the longer-term attitude of the market is decidedly negative, but also that the market has a massive amount of support underneath. At this point, I believe that the market will continue to be one that offers play of opportunity, but you need to be patient enough to wait for the selling opportunities to present themselves. I don’t wish to buy the market, simply because I do not trust the bullish moves for any length of time. Those who are bit nimbler may want to go back and forth, but I believe that the extreme strength of sellers should offer a bit more comfortable.

NATGAS Video 11.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement