Advertisement

Advertisement

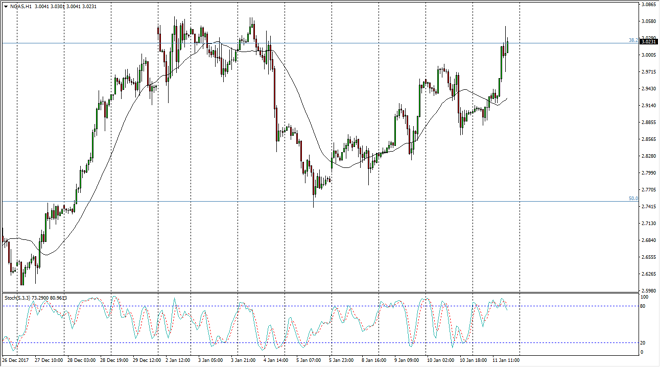

Natural Gas Price Forecast January 12, 2018, Technical Analysis

Updated: Jan 12, 2018, 04:58 GMT+00:00

Natural gas markets were very choppy during the session on Thursday, which of course isn’t much of a surprise considering that the Natural Gas Storage figures came out of the United States. With more natural gas use last week than anticipated, this has put some upward pressure in the marketplace as one would expect. However, I think that the longer-term point of view is one you should pay attention to.

The natural gas markets have rallied significantly during the trading session on Thursday, breaking above the $3 handle. I think there is a significant amount of resistance extending to the $3.10 level though, so it’s likely that the markets will continue to find resistance above, and I think that selling pressure will eventually present itself. Having said that, I would not be shorting this market right now. I would wait for a day or 2 of exhaustion before start shorting. If we break above the $3.20 level, that would be a very bullish sign. Until then, I look at this is a potential selling opportunity but certainly will let the market tell me when it’s ready to roll over.

The market should continue to be one that is very volatile, as the natural gas markets are very thin, and of course the seasonality comes into play while at the same time dealing with the mass of oversupply in the natural gas markets will cause a lot of noise. The seasonality is positive for natural gas, but quite frankly every time we have rallied significantly, the market has rolled over again. Cold weather is coming to the northeastern part of the United States again, so that could be bullish, but in the end sellers are willing to jump into the market above the $3 level handily.

NATGAS Video 12.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement