Advertisement

Advertisement

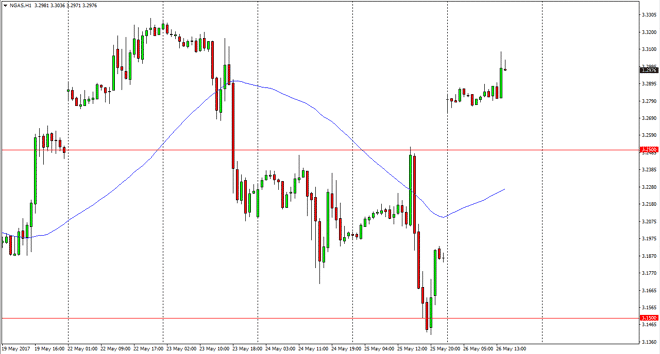

Natural Gas Price Forecast May 29, 2017, Technical Analysis

Updated: May 27, 2017, 04:59 GMT+00:00

The natural gas market gapped higher at the open on Friday, clearing the $3.25 level in the process. We did pull back just a bit, but found the $3.25

The natural gas market gapped higher at the open on Friday, clearing the $3.25 level in the process. We did pull back just a bit, but found the $3.25 level to be supportive enough to keep the market afloat. Ultimately, I believe we will be looking at the $3.33 level, and a break above there should send the market looking for the $3.40 level next. Pullbacks of this point should be buying opportunities, as they have been time and time again. When you look at the overall attitude of the market, it has been a slow grind higher, and I think that will continue to be the case. The $3.15 level below being broken to the downside would be sufficiently negative enough to send the market filling the gap to the 3.05 level on the bottom.

Volatility should continue

I believe that the volatility should continue, because quite frankly the natural gas markets are difficult under the best of times. The market continues to show the typical choppiness that as seen in the natural gas markets, but I believe that it’s only a matter of time before the buyers return, and you can see that the recent high is higher than the one before, just as the recent low is higher than the one before that. That’s the epitome of a longer-term uptrend, but with the cost of the natural gas futures markets, you may be better served trading in the contract for difference markets, as at least then you can be more stringent when it comes to the size of the trade that you take on. With the volatility, that’s probably the best thing that you can do, protect your trading capital by not dealing with the futures markets directly.

NATGAS Video 29.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement