Advertisement

Advertisement

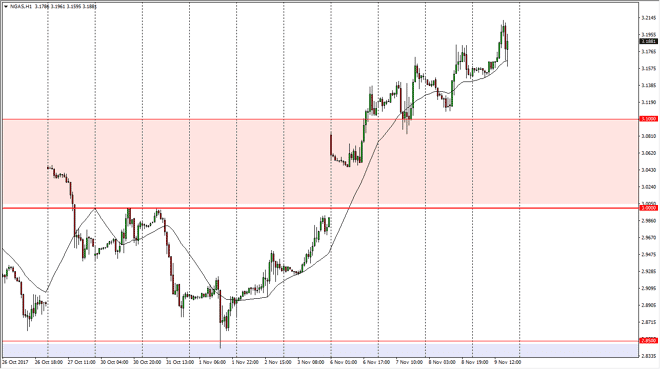

Natural Gas Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:34 GMT+00:00

Natural gas markets rallied yet again during the trading session on Thursday, reaching towards the $3.20 level. We pulled back a bit, and then found the

Natural gas markets rallied yet again during the trading session on Thursday, reaching towards the $3.20 level. We pulled back a bit, and then found the 24-hour exponential moving average to offer dynamic support again. I think that the $3.10 level underneath is the “floor” in the short-term uptrend, and the seasonality of natural gas is starting to come into play. Temperatures are diving in the United States, so that means that we should see increased demand, and then on top of that, the stores of natural gas were a bit lower than anticipated. That being said, longer-term we certainly have a lot of supply out there that can fill those tanks, but it will take a while to get to that point. I think that we are now in the cyclical bullish fall and winter, it makes sense that traders will be trying to go long of natural gas as they have several times in the past. However, this will be short-lived.

I believe that somewhere near the $3.30 level we should see a bit of a ceiling, and it’s likely that we will see a significant amount of selling pressure in that general vicinity. If we were to break down below the $3.10 level, I think we would probably go to looking to fill the gap, down at the $3.00 level. Overall, I’m still very bearish and natural gas, but this is the time of year that we tend to see a lot of buying, and that seasonality looks to be taking control of the market. As soon as we get close to springtime though, I expect natural gas markets will completely roll over. If we were to break down below the $3.00 level, things could get ugly rather quickly.

NATGAS Video 10.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement