Advertisement

Advertisement

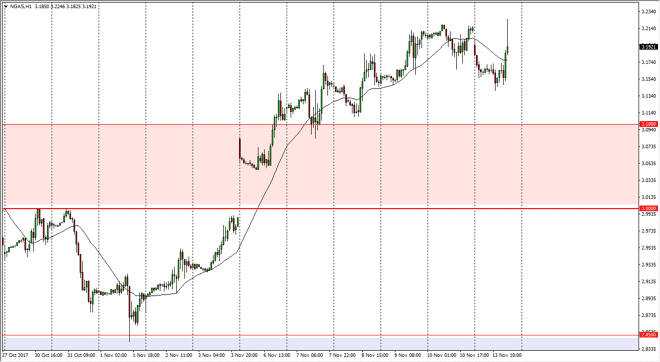

Natural Gas Price Forecast November 14, 2017, Technical Analysis

Updated: Nov 14, 2017, 04:43 GMT+00:00

Natural gas markets gapped lower at the open on Monday, and then dropped down to the $3.15 level to find support. We bounce from there and filled the gap

Natural gas markets gapped lower at the open on Monday, and then dropped down to the $3.15 level to find support. We bounce from there and filled the gap next, forming a bit of a shooting star on the hourly chart. It’s possible that we could pull back from here, but I expect the $3.10 level to offer support. If we can break above the top of the shooting star on the hourly chart, essentially the $3.23 level, the market should continue to go much higher and continue the uptrend. I believe that’s what will happen eventually, the question is whether we get that move right away, or do we get a pullback offering value? While I am very negative on natural gas longer-term, I recognize that with the short-term seasonality coming back to the markets, it makes sense that natural gas will continue to strengthen. Temperatures are getting colder in the United States, and that should offer plenty of reason for the buyers to become optimistic, at least until January.

If we do break down below the $3.10 level, the market will probably go looking towards the $3.00 level underneath, to fill the gap that happened several sessions ago. A move below the $3.00 level would be absolutely catastrophic, but I suspect that isn’t very likely to happen, least not anytime soon. Pullbacks should continue to offer value, and I think most traders around the world will be looking at this market as such. The $3.30 level should continue to be the target over the next several sessions, but we are a bit extended, so it makes sense that we need to pull back and take a bit of a breather after this massive breakout. Expect choppy, yet positive action over the next several days.

NATGAS Video 14.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement