Advertisement

Advertisement

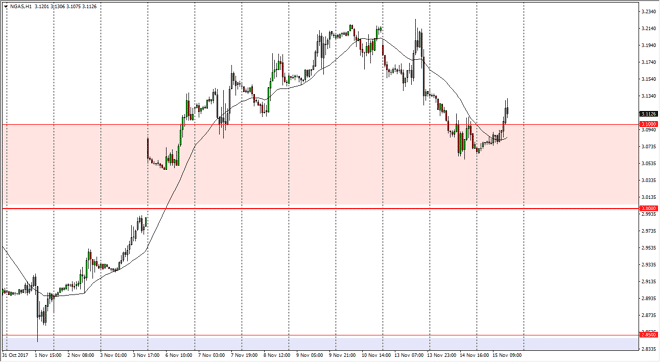

Natural Gas Price Forecast November 16, 2017, Technical Analysis

Updated: Nov 16, 2017, 05:15 GMT+00:00

Natural gas markets rally during the trading session on Wednesday, breaking above the $3.10 level, to show signs of buoyancy again. Although we did not

Natural gas markets rally during the trading session on Wednesday, breaking above the $3.10 level, to show signs of buoyancy again. Although we did not fill the gap underneath, sometimes gaps only get tested and things turn around. That might be what we are seeing right now, and at this point either way I think that it is a “long only” market, least until we would break down below the $3 handle. The market of course is going through some seasonality adjustments, as there is much more demand for natural gas during these next couple of months in the northeastern corner of the United States, which has gotten colder recently. Because of this, I look at dips as buying opportunities, but I recognize it’s going to be a choppy market, natural gas typically is. I think that we could go as high as $3.30 above, and then possibly even $3.50 of it is a particularly cold winter in America.

If we were to break down below the $3 level, that would be very negative turn of events and have me shorting this market aggressively. However, I think it’s very unlikely to happen although we will get the occasional pullback, but more likely just to build up the necessary momentum to continue the move higher. Longer-term, there is a glut of natural gas out there, so it’s difficult to imagine that the pricing power is going to last more than a couple of months, but currently it looks as if selling is a very dangerous proposition indeed, which is quite ironic considering just a couple of weeks ago it’s the only thing you can do. Keep your position size small if at all possible, natural gas tends to be very thin trading at times.

NATGAS Video 16.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement