Advertisement

Advertisement

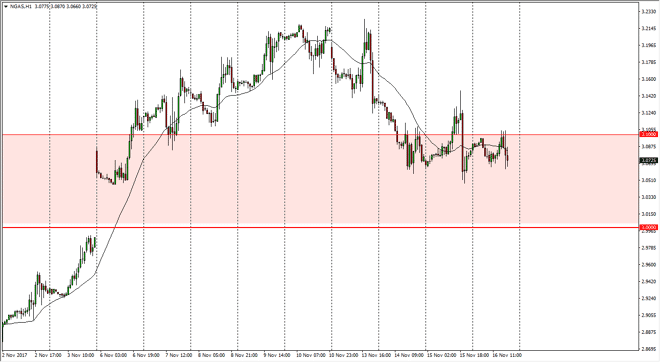

Natural Gas Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 05:00 GMT+00:00

Natural gas markets have continued to go sideways in general, showing signs of resistance at the $3.10 level, an area that has been important in the past.

Natural gas markets have continued to go sideways in general, showing signs of resistance at the $3.10 level, an area that has been important in the past. It looks as if we are going to roll over from here, perhaps going down to the $3.00 level. By doing so, we look likely to fill the gap that have appeared a couple of weeks ago, but I expect to see support at $3. If we bounce from there, it’s likely that we continue to see a rally and perhaps a reach to the $3.20 level. The seasonality of the market is positive, as we are getting colder temperatures in the United States, and I think that we will see plenty of bullish pressure due to increasing demand. Ultimately, the market should then go to the $3.30 level, and then possibly even the $3.50 level after that. However, we always need to keep the alternate scenario in mind.

If we were to break down below the $3.00 level on a daily close, that would be an extraordinarily negative sign, because if we cannot sustain a rally in the dead of winter for the United States, when could we? That would have me not only selling this market, but aggressively so. Longer-term, I remain very negative of natural gas, as the supply far outweighs the demand, but this time year always tends to be a bit better for the buyers, as it makes sense with so many heating systems in the United States being fueled by natural gas. However, it is almost impossible to burn through the supply that we have now, so longer-term I am still seller. I believe that if we do rally from here for the next couple of months, somewhere in January, we should get an excellent shorting opportunity for a huge move.

NATGAS Video 17.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement