Advertisement

Advertisement

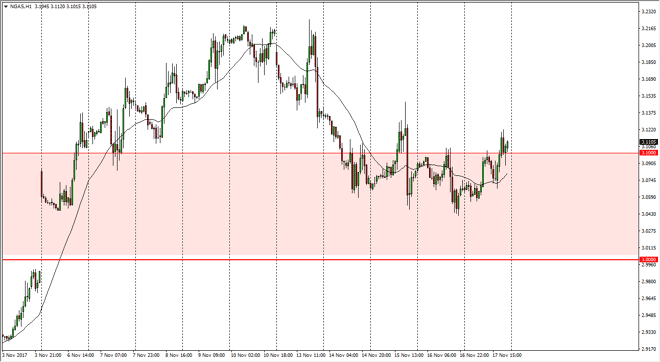

Natural Gas Price Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:29 GMT+00:00

The natural gas markets rallied a bit during the session on Friday, breaking above the $3.10 level. Ultimately, this is a market that could continue to go

The natural gas markets rallied a bit during the session on Friday, breaking above the $3.10 level. Ultimately, this is a market that could continue to go higher, perhaps reaching towards the $3.25 level above. The market pulling back suggests to me that the buyers are coming in on value, and that the gap underneath should continue to be supportive. I believe that the $3.00 level underneath is the “floor” in the market, and therefore I would be very surprised if we break down below there. If we did, that would be catastrophic for the market, as it would go against the seasonality that we are starting to see play out. After all, there are colder temperatures in the United States now, and that means that there should be more demand.

With that demand, we should see the market go to the $3.25 level again, and then eventually the $3.50 level after that. Overall, this is a market that I believe in buying the dips, as they offer value. That value should continue to offer opportunities between now and the end of the year, which is typical for the natural gas markets, rallying into the new year. However, longer-term I have an outlook that is very negative for this market as we are far too oversupplied, but is probably not until January that we start to see massive selling. That’s not to say it will be volatile, just that I think the next 8 to 10 weeks should be bullish. Because of this, I am a buyer of these dips going forward, and I have no interest in shorting, unless of course we were to break down below the $3.00 level, something that I do not expect to see anytime soon.

NATGAS Video 20.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement