Advertisement

Advertisement

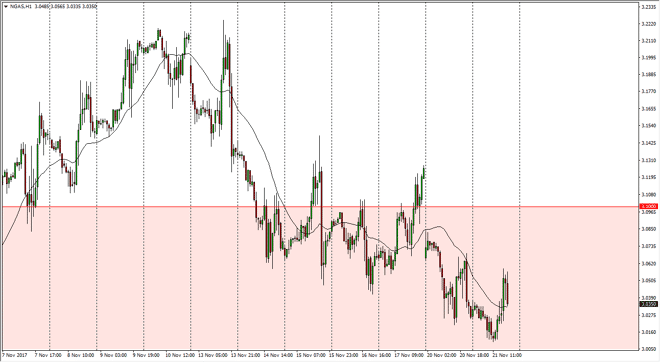

Natural Gas Price Forecast November 22, 2017, Technical Analysis

Updated: Nov 22, 2017, 05:18 GMT+00:00

Natural gas markets continue to be very choppy, as we drifted a bit lower initially during the trading session on Tuesday, but found support just above

Natural gas markets continue to be very choppy, as we drifted a bit lower initially during the trading session on Tuesday, but found support just above the $3.01 level, and rallied towards the $3.06 level. We pull back from there as well, and I think what we are going to see over the next 24 hours it is a lot of volatility and choppiness, ultimately sending this market towards the $3.10 level. The $3 level has been important in the past more than once, and it was the scene of a massive gap a couple of weeks ago, as we entered the “high demand season” for natural gas in the United States. Typically, the months of November and December are very bullish for natural gas, as temperatures plunge in the northeastern part of the United States. That is initially what we have been seen as of late, but we did gap lower a couple of sessions ago. Right now, I think that we are going to continue to see buyers jump in on dips, and that we are trying to reach towards the gap from a couple of days ago, sending this market towards the $3.12 level. I believe that longer-term, we go towards the $3.25 level, and perhaps even the $3.50 level.

If we were to break down below the $2.98 level, the market could go as low as the $2.85 level underneath. That’s an area that is massively supportive, but if we were to break down at this point, I would be rather surprised as it would be an extraordinarily bearish thing to see this late in the year. Longer-term, I’m still very bearish of natural gas, as the oversupply continues to be a major issue. However, in the short-term buyers will more than likely take advantage of the seasonality.

NATGAS Video 22.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement