Advertisement

Advertisement

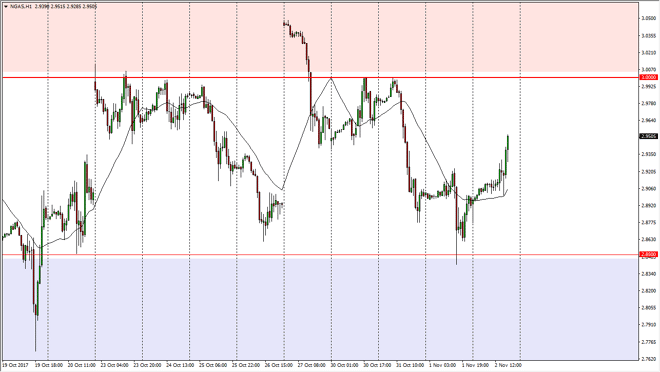

Natural Gas Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:18 GMT+00:00

Natural gas markets went a little bit higher during the day initially, but then exploded to the upside. However, we are still well within the

Natural gas markets went a little bit higher during the day initially, but then exploded to the upside. However, we are still well within the consolidation area that the market has been stuck in for several weeks, and I believe that once we get close to the $3 level, it’s likely that we will see quite a bit of selling in that general vicinity as US fracking company suddenly find themselves making money at that level. I believe that the resistance barrier extends to the $3.10 level above, so it’s only a matter of time before the sellers come back into this market place as far as I can see, so I’m looking for the first signs of exhaustion to start selling again. This will be exacerbated at the US dollar strengthens after the jobs number, but there is the alternate argument that could be made that there could be more demand for natural gas if the jobs number is strong.

In the end, this is a marketplace that continues to be tightly contested, so it’s likely that short-term trading continues to be the best way to get involved. I also like the idea of using range bound trading systems as we will more than likely continue the overall bouncing around that we have seen for some time. I think that if we were to break down below the $2.75 level, that would be catastrophic for natural gas, but I don’t think it’s going to happen as the winter months are approaching in the United States, so that will pick up demand a little bit, but the oversupply is so drastic that breaking through that barrier to the upside is probably going to be something that is a long way from happening.

NATGAS Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement