Advertisement

Advertisement

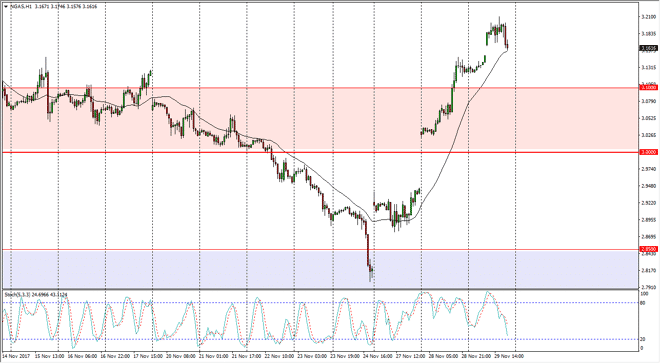

Natural Gas Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:05 GMT+00:00

Natural gas markets gapped higher as Americans came back to work on Wednesday, rallied a bit towards the $3.20 level, and then pulled back to reach lower

Natural gas markets gapped higher as Americans came back to work on Wednesday, rallied a bit towards the $3.20 level, and then pulled back to reach lower and fill the gap. The 24-hour exponential moving average seems to be offering support on the hourly chart, so looks like we are ready to continue going higher. This is a market that has been extraordinarily noisy and even more so dangerous lately, as we have been gapping higher and lower rather violently. Because of this, trading this market is very dangerous to do currently, unless of course you have the proper money management, which is very difficult to achieve if we continue to gap the way we have. It is because of this, that I feel Newark traders are probably best served by sitting on the sidelines, as the potential for significant damage to your trading account is high.

I would suggest that using the CFD market is probably as good as it gets right now, and as we are now starting to ignore support and resistance, this market has become driven by emotion more than anything else, trading off of weather forecast for the following week. For those of you who have never been to the United States, the northeastern part of the country is a massive consumer of natural gas, so pay attention to the New York area forecasts. The lower the temperature, the more demand we will have for natural gas. This is a bit of a phenomenon that we see in December and January, but sometime in the middle of January we will see futures markets look towards Spring, and that means a violent selloff. This market has been very difficult to deal with lately, and quite frankly you are probably better served in other markets.

NATGAS Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement