Advertisement

Advertisement

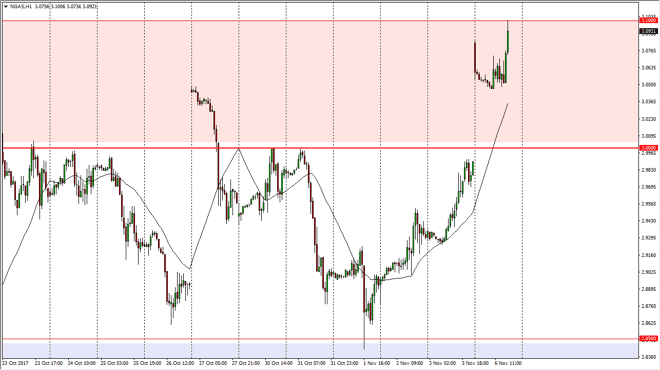

Natural Gas Price Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:02 GMT+00:00

Natural gas markets gapped higher at the open on Monday, pulled back slightly towards the $3.05 level, and then slammed into the $3.10 level. That’s an

Natural gas markets gapped higher at the open on Monday, pulled back slightly towards the $3.05 level, and then slammed into the $3.10 level. That’s an area that has caused a lot of resistance, so it’s not surprising that we cannot break above there as I record this. However, if we close above there on a daily close, it’s likely that we continue to go even higher. We are approaching colder temperatures in the northeastern part of the United States, which quite often has a large influence on the natural gas markets. However, it will take a significant amount of bullish pressure to send this market higher, but on the weekly chart we have been forming hammers as of late, so perhaps we are ready for the seasonal break out. If that’s the case, we could end up going a bit higher, perhaps even as high as $3.20 above, but until we get the daily close, I am not willing to put money to the upside.

A pullback from here would have the market trying to fill the gap, going back down to the $3.00 level as well. If we break down below that, then we returned to the previous consolidation area, meaning that we could have a massive move down to the $2.85 level. Nonetheless, I think you should probably wait for some type of daily close to make your decision, because quite frankly this could be very violent and very dangerous. In general, I remain bearish longer-term, but obviously it looks as if we are trying to break out in the short term. The market should continue to be violent, which is typical for the natural gas markets. However, I do know that there is a massive oversupply of supply in the markets, and a dumping of that could continue to affect things.

NATGAS Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement