Advertisement

Advertisement

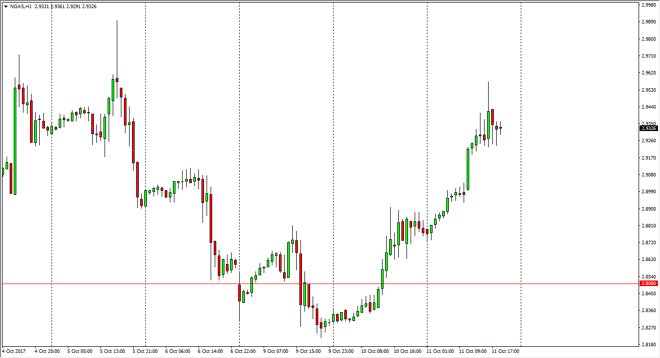

Natural Gas Price Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:54 GMT+00:00

The natural gas markets rallied significantly during the day on Wednesday, reaching towards the $2.95 level. I believe that there is a significant amount

The natural gas markets rallied significantly during the day on Wednesday, reaching towards the $2.95 level. I believe that there is a significant amount of resistance near the $3.00 level, so I’m looking for signs of exhaustion to start selling. I think that sitting on the sidelines to be the best way to trade this market, as we have seen in a significant amount of selling in that area. And it makes a lot of sense as well, because the US fracking companies find that area expensive enough to turn a profit in this market place. Because of this, there is plenty of support above, and it’s likely that the sellers will continue to jump in as oversupply continues to be a major issue. I believe the natural gas markets are not to be able to break out significantly, least not for any real length of time, so I’m looking for opportunities to get shorter this market yet again.

For several months now, I have been selling this market every time we show signs of exhaustion or get too expensive, and I suspect that a lot of the major players are doing the same thing. Remember, these markets serve a real function beyond speculation, and because of this I think that the suppliers of natural gas are coming into the marketplace every time you get a chance, and profiting where it’s possible. I believe that the market will continue to bounce between the $3.00 level and the $2.85 level over the next several weeks, with some variation occasionally, because the market of course is a bit less liquid than some other major futures markets. Ultimately, I’m a seller and have no interest in going long anytime soon as I believe this market has far too much overhang.

NATGAS Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement