Advertisement

Advertisement

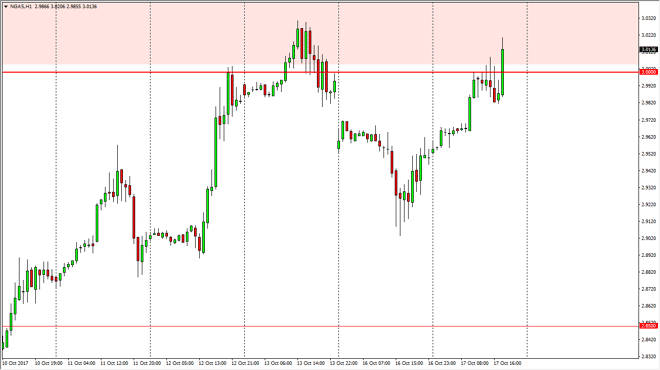

Natural Gas Price Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:55 GMT+00:00

Natural gas markets rallied a bit during the day on Tuesday, slicing through the $3.00 level. This is an area that has been massively important in the

Natural gas markets rallied a bit during the day on Tuesday, slicing through the $3.00 level. This is an area that has been massively important in the past, as we have turned around and fallen from here more than once. I think that the market should continue to be difficult to navigate to the upside, and it’s likely that we will see sellers jump back into this market place as there is an oversupply of natural gas. Beyond that, I recognize that the US fracking companies make money above the $3.00 level, and therefore their willing to dump their supply of natural gas into the marketplace, offering massive resistance. Because of this, I continue to sell this market every time we get close to this area, as I recognize that the overall trend of the market is sideways, and it’s likely that we will continue to see that going forward as the oversupply of natural gas will continue to be difficult to deal with.

If we roll over from here, and break down below the $2.97 level, the market should continue to go much lower, perhaps reaching towards the $2.92 level. I have no interest in trying to buy this market, and I believe that if we break above the highs from the recent action, then the market could go closer to the $3.10 level above, but that is massively resistive. Either way, I’m looking to sell as soon as I can, and I think that eventually we will go looking towards the $2.85 level below. This massive volatility should continue to be a mainstay in this market, so therefore patience is needed to pick your battles, and take advantage of overbought conditions. If we can break down below the $2.85 level, the market could then go down to the $2.75 level.

NATGAS Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement