Advertisement

Advertisement

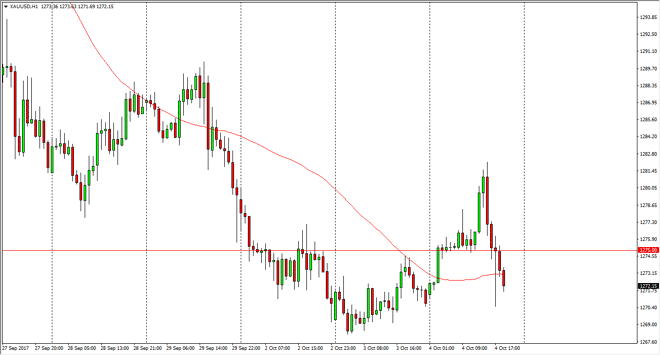

Natural Gas Price Forecast October 5, 2017, Technical Analysis

Updated: Oct 5, 2017, 05:30 GMT+00:00

The natural gas markets went sideways initially during the day on Wednesday, but then spiked higher to reach the $2.97 level. This is an area that began

The natural gas markets went sideways initially during the day on Wednesday, but then spiked higher to reach the $2.97 level. This is an area that began significant resistance, and the shooting star on the hourly chart also suggests that we won’t be holding onto these gains for any significant amount of time. This is not a surprise, because quite frankly the oversupply of natural gas is a systemic problem, and of course we have the $3 level above which has been a massive barrier. Once we break above the $3 handle, the fracking producers in the United States suddenly become profitable again, and therefore have a ton of supply above that level. With that in mind, I believe in selling rallies, as it has served the market so well over the longer term.

I believe that the $2.85 level underneath will be the floor in the market on the short-term, but once we break down below there we will probably go looking towards the $2.75 level. I have no interest in buying this market, there is simply far too much in the way of negativity longer term. I recognize that we are heading into a cooler part of the year for the United States, but quite frankly there is so much natural gas out there that it is almost impossible to imagine holding onto a trade for any length of time to the upside. In fact, I think that the market cannot rally for any significant amount of time going forward as the suppliers will be very quick to dump off natural gas at profitable levels, something that they have not seen much of this year. Simple supply and demand continues to be a major issue. Because of this, selling is all I can do.

NATGAS Video 05.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement