Advertisement

Advertisement

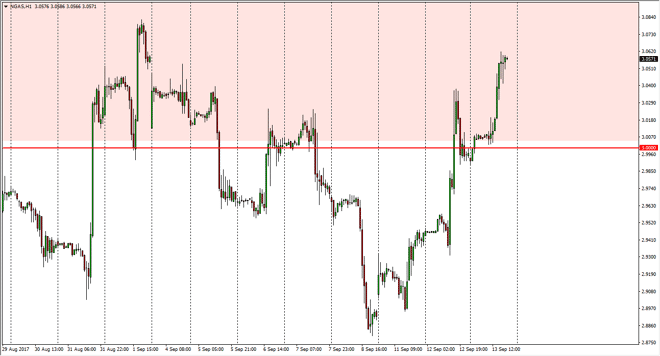

Natural Gas Price Forecast September 14, 2017, Technical Analysis

Updated: Sep 14, 2017, 07:36 GMT+00:00

Natural gas markets rallied during the day on Wednesday again, using the $3.00 level as a springboard. However, towards the end of the day we saw the

Natural gas markets rallied during the day on Wednesday again, using the $3.00 level as a springboard. However, towards the end of the day we saw the markets struggle near the $3.06 level, an area that we had gapped down from previously. The question now is whether we have enough momentum to continue going higher, and break above the $3.10 level. At this point, although this rally has been impressive, we have seen this before and we’ve also seen this market fail. I’d be very reluctant to buy up at this area, and realize that the risk reward ratio from the longer-term charts favors the downside. That’s not to say that it’s going to be an easy trade, just that history has shown this area to be very resistive. The situation with the hurricane damage in the Gulf of Mexico has caused a bit of disruption in the markets as well, so there are a lot of moving pieces and therefore makes this a very difficult market.

Keep in mind that natural gas markets tend to be much thinner than other markets like crude oil, so the moves tend to be a bit exaggerated in both directions. I think that if we break below the $3 level on a daily close, that’s a clearly bearish sign, just as a daily close above the $3.10 level would be clearly bullish. In the meantime, I suspect that you are going to see a lot of choppiness and skittish behavior, as damage assessments come through and overall demand questions remain. With this being said, I still believe in the longer-term bearish picture, but will wait to see what the markets tell me to do to place more money to work. I’m looking for a selling opportunity in this general vicinity, but don’t see one.

NATGAS Video 14.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement