Advertisement

Advertisement

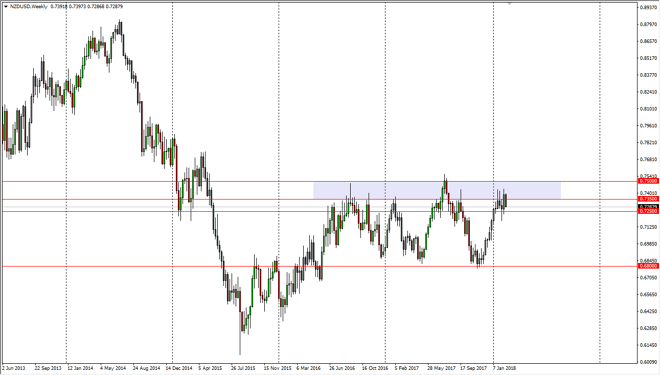

NZD/USD forecast for the week of February 26, 2018, Technical Analysis

Updated: Feb 24, 2018, 04:17 GMT+00:00

The New Zealand dollar fell a bit during the session, reaching down towards the 0.7250 level. That’s an area that is supportive, especially considering that the hammer that formed a couple of weeks ago is based upon that level. However, there is a lot of resistance above.

The New Zealand dollar has pulled back during the week, testing the 0.7250 region. This is an area that has been supportive recently, and I think that the market will continue to be an opportunity to pick up to the upside, but it will be difficult to trade from a longer-term perspective as the market is consolidating in a very tight range for longer-term traders. I also recognize that there is a lot of noise above, and I have marked on the chart as a lavender rectangle. If we can break above the 0.75 handle, the market should continue to go much higher, perhaps reaching towards the 0.7750 level.

The market has a significant amount of support below, but if we did breakdown below there, the market could reach down towards the 0.68 handle. The market continues to react against the overall attitude of both commodity and stock markets, and as they both rally, that should help the New Zealand dollar as well. I recognize that there is a large amount of noise around the pair right now, but I do favor the upside. If we were to break down below the bottom of the hammer from a couple of weeks ago though, that could offer a short-term selling opportunity as we continue to try to build up enough momentum to break out to the upside. I have a longer-term negative bias on the US dollar, but I obviously have to trade the market that I’m offered, meaning that I would not hesitate to sell if we do in fact get the breakdown.

NZD/USD Video 26.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement