Advertisement

Advertisement

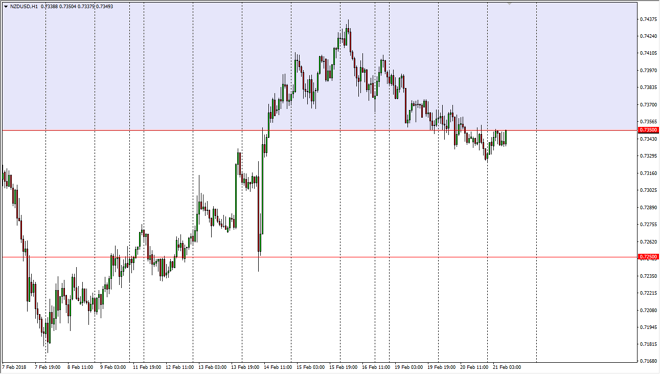

NZD/USD Price Forecast February 22, 2018, Technical Analysis

Updated: Feb 22, 2018, 04:58 GMT+00:00

New Zealand dollar traders rallied the market during the trading session on Wednesday, reaching towards the 0.7350 level. If we can break above that level, the market should continue to go higher, and I can make an argument for a downtrend line being broken as I record this. Eventually, I anticipate that the New Zealand dollar will go towards the 0.74 level, but it might be a bumpy ride towards that area.

I believe that the New Zealand dollar is trying to form a bit of a base in the 0.7350 level, as we have seen significant building of pressure over the last 24 hours. I believe that if we can break above the 0.7365 level, the market will continue to go much higher, perhaps reaching towards 0.74, and then make another attempt at the 0.75 level above, which has been a massive “zone” of resistance. If we can break above the 0.75 level, that should send this market much higher, perhaps reaching towards a “buy-and-hold” situation. I think that the market is eventually going to do just that, and I believe that the US dollar will continue to struggle longer term.

Pay attention to the bond markets, because if the US bonds start to sell off again, that will be reason enough to see the NZD/USD pair continue to rally, as the US dollar will sell off everywhere. The New Zealand dollar is a bit thinner than some of the other major currency pairs, so it would make for a larger move than many other major pairs. I think that eventually we will run into some exhaustion and pull back enough to find enough value to rally yet again. I have no interest in shorting this market, it looks far too bullish.

NZD/USD Video 22.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement