Advertisement

Advertisement

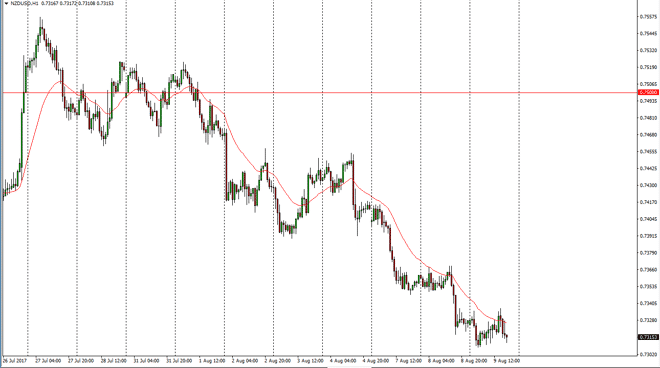

NZD/USD Forecast August 10, 2017, Technical Analysis

Updated: Aug 10, 2017, 06:20 GMT+00:00

The New Zealand dollar went sideways during most of the session on Wednesday, as we continue to see the 0.73 level offer a bit of support. If we can break

The New Zealand dollar went sideways during most of the session on Wednesday, as we continue to see the 0.73 level offer a bit of support. If we can break down below there, the market should be free to go to the 0.72 level next. Remember that the New Zealand dollar is going to be sensitive to commodity markets, and of course are taken a beating as the safety play is on. This is mainly due to the rhetoric coming out of Washington and Pyongyang, which is absolute nonsense. However, the attitude of the market is more of a “risk off” type of situation, so it makes sense of the New Zealand dollar gets beaten-down.

Selling rallies

I’m a seller rallies in this market, as I believe we will continue to see bearish pressure in the commodity currencies overall. It’s not until we break above the 0.74 level that I would consider buying, and then we have to wait to see what happens at the 0.75 level above there which will be massively resistive. I believe that the very first signs of exhaustion on short-term rallies should offer opportunities, and that the US dollar will continue to strengthen worldwide. The New Zealand dollar is obviously sensitive doll things in Asia, so it makes sense that we would see a bit of trouble over here. Beyond that, the Royal Bank of New Zealand does not look likely to raise rates anytime soon, so I believe that we will continue to see sellers.

NZD/USD Video 10.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement