Advertisement

Advertisement

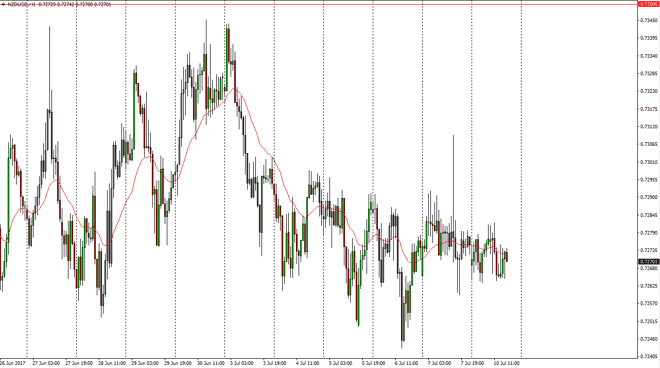

NZD/USD Forecast July 11, 2017, Technical Analysis

Updated: Jul 11, 2017, 05:44 GMT+00:00

The New Zealand dollar went back and forth on Monday as we continue to see choppiness. Quite frankly, this is one of the least volatile markets that I am

The New Zealand dollar went back and forth on Monday as we continue to see choppiness. Quite frankly, this is one of the least volatile markets that I am following right now, so I don’t have any interest in placing a significant amount of money in this market. I think that the 0.72 level underneath should continue to offer support, and therefore dips could be buying opportunities, but quite frankly this is a market that is moving in slow motion. Because of this, I think that the markets may be very difficult to trade over the next several sessions, and as a result I think that we will eventually break to the upside, but we need some type of catalyst to do so. If we do break to the upside, I think the market may go looking for the 0.7350 level above, which has been important in the past.

Small positions only

I believe that this is a market that small positions are about the only thing that you can get involved with, as you will be tying up far too much margin if you are heavily invested in this market. The commodities markets are highly influential of the New Zealand dollar, but currently there isn’t much to move the markets overall, and the next couple of sessions are very light with economic announcements. Because of this, I believe that this is a market that quite frankly will be difficult to deal with when it comes to larger positions, because there will be other more lucrative propositions in the Forex markets that you can take advantage of. If we did breakdown below the 0.72 level, then I think we could get a little bit of a selloff. Ultimately, we are just treading water.

NZD/USD Video 11.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement