Advertisement

Advertisement

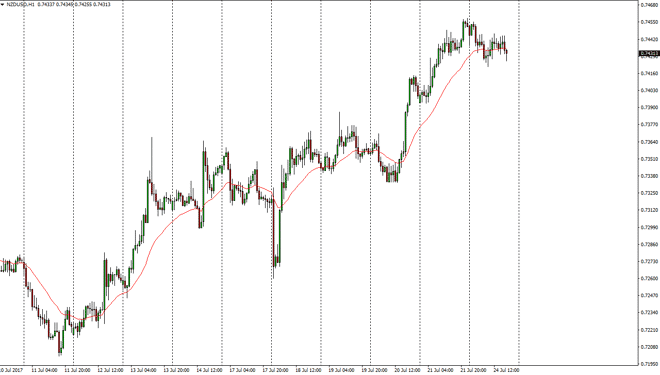

NZD/USD Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:14 GMT+00:00

The New Zealand dollar fell slightly at the beginning of the session on Monday, but continues to find support at the 0.74 handle. However, it looks as if

The New Zealand dollar fell slightly at the beginning of the session on Monday, but continues to find support at the 0.74 handle. However, it looks as if the market is ready to grind sideways and therefore I think that it’s only a matter of time before we find buyers. The market will have to deal with the 0.75 level above, which will be psychologically resistant, and of course is important on longer-term charts. Because of this, I think you’re looking at a lot of choppiness in the meantime, and could even pull back further, perhaps testing the 0.74 handle. I don’t have any interest in selling this market though, because the US dollars most certainly looked at negatively around the world currently. The US dollar is being sold off against most currencies, and although the New Zealand dollar may struggle a bit from time to time, ultimately US dollar weakness will continue to be a major factor in this market.

0.75

If we can break above 0.75, then I feel that the market continues to go much higher. I think that a break above there should send this market towards the 0.76 handle next, and eventually take off beyond there. Longer-term, I believe that the buyers will win this market, but we could get a pullback to build up enough momentum. I think that should be looked at as value, mainly because the markets tend to be choppy in general during the summer months, and although this value will present itself it may just be short-term lived at best. Longer-term, looks as if the US dollar is going to continue to be on its back foot. It’s not until we break down below the 0.73 level that I would consider selling, and that doesn’t look very likely to happen.

NZD/USD Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement