Advertisement

Advertisement

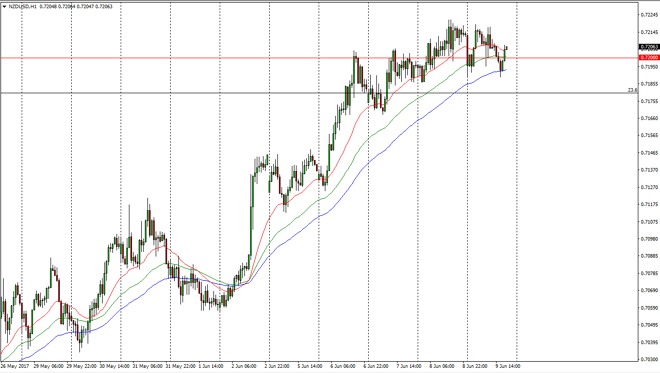

NZD/USD Forecast June 12, 2017, Technical Analysis

Updated: Jun 10, 2017, 04:06 GMT+00:00

The New Zealand dollar was volatile during the session on Friday, as we continue to hover about the 0.72 level. We were remarkably quiet during the day,

The New Zealand dollar was volatile during the session on Friday, as we continue to hover about the 0.72 level. We were remarkably quiet during the day, and I believe that the market is trying to consolidate in this area to build up enough pressure for the move higher. After all, we been in a nice uptrend for the last several sessions, and perhaps a little bit of a breather is needed to build up the momentum necessary to go to the 0.72 level. A pullback from here could offer a bit of a buying opportunity, as the 0.7150 level below would be supportive as well. I believe that the market will find value hunters every time we pull back, and longer-term will continue to offer an opportunity to pick up the New Zealand dollar in bits and pieces to build a larger position.

Risk on/risk off

This is a risk sensitive pair, so pay attention to commodity markets and how they are behaving as to where to trade next. The New Zealand dollar has the added benefit of having a positive swap, something that you don’t see everywhere in the Forex markets. In the low rate environment, even though the New Zealand dollar is historically low rate, the reality is that it’s one of the few that gives you money every time you hang onto it for 24 hours. Although it doesn’t seem like that much, don’t let it for you, there are still plenty of carry traders out there willing to take advantage of that. You can see that the blue 72-hour exponential moving average has offered support during the day on Friday, so I think the buyers are continuing to accumulate a bit of position before the next move higher.

NZD/USD Video 12.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement