Advertisement

Advertisement

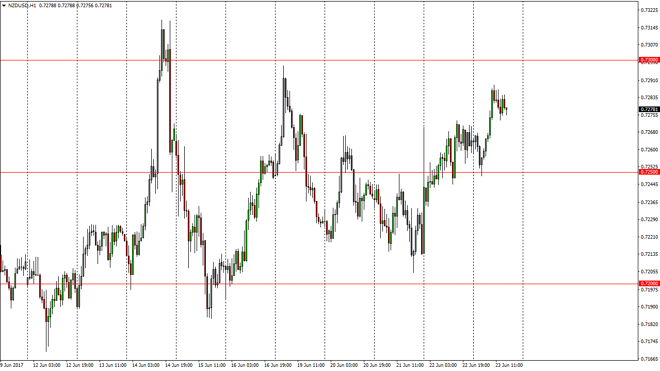

NZD/USD Forecast June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:11 GMT+00:00

The New Zealand dollar initially fell during the session on Friday, reaching towards the 0.7250 level, but bouncing from there and exploding to the

The New Zealand dollar initially fell during the session on Friday, reaching towards the 0.7250 level, but bouncing from there and exploding to the upside. The 0.73 level above is massively resistive, and with this being the case if we can break above there are think that the market can continue to go towards the 0.75 handle. This is a market that continues to be very choppy, and a break above the 0.73 level should continue to send this market towards the 0.75 level based upon the technical analysis. With this in mind, I think we are getting ready to break out of the technical consolidation between the 0.72 level on the bottom and the 0.73 level on the top. The New Zealand dollar is heavily influenced by the commodity markets, so that of course will come into play.

General barometer

I always look at the New Zealand dollar as a general barometer on how they commodity markets “feel.” And because of this, I believe that the market should continue to pay attention to not only agricultural commodities, but even commodities such as gold and silver. Ultimately, I believe that the markets should break out to the upside and grind even higher as the precious metals will help, and agricultural futures should continue to have a bit of a bed longer term. I have no interest in shorting this market, least not until we break down below the 0.75 level, which is something that does look very likely to happen. Because of this, I think that there should be plenty of buying opportunities and support underneath, especially near the 0.7275 handle. Expect choppiness, but I would expect to see a significant upward pressure as well, as the New Zealand dollar has outperformed all other commodity dollars.

NZD/USD Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement