Advertisement

Advertisement

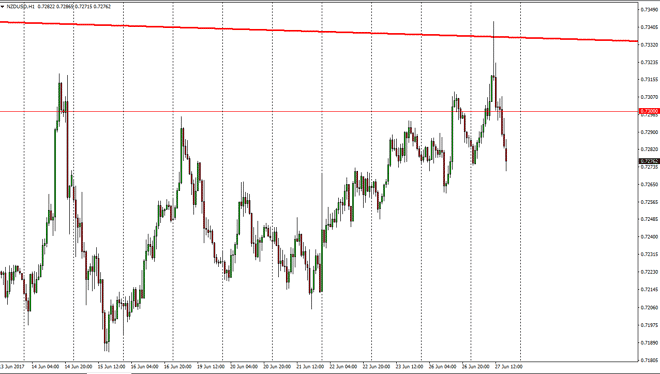

NZD/USD Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:46 GMT+00:00

The New Zealand dollar initially tried to rally during the day on Tuesday, but found trouble yet again at the downtrend line that is based upon the weekly

The New Zealand dollar initially tried to rally during the day on Tuesday, but found trouble yet again at the downtrend line that is based upon the weekly market. We ended up forming a shooting star on the hourly chart, and then fell significantly. We ended up forming a shooting star for the day, and that suggests that perhaps we are going to break down. So, having said that, if we can break down below the 0.7250 level, I think that the market then goes down to the 0.7215 handle. If we rally, I’m not interested in buying this market until we break above the uptrend line, and of course the top of the shooting star. Ultimately, this is a market that is should continue to go to the upside if we can break the candle, as it would not only show a breakout above a shooting star, but of course that aforementioned downtrend line.

Commodity markets

Commodity markets of course can move the New Zealand dollar as it is a barometer of the overall health of commodities, and the markets will continue to be very volatile as we have a lot of questions when it comes to global growth, and even growth in the United States. The New Zealand dollar of course is agriculturally driven more than anything else, but is one of the least liquid Major pairs, so it will make a significant move in short order. Given enough time, the market should continue to be very choppy, but I think we will make a serious move in the market, giving us an opportunity to get involved and place a longer-term trend. However, the choppiness should continue to be a given no matter what happens next, as the summer months tend to provide then liquidity.

NZD/USD Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement