Advertisement

Advertisement

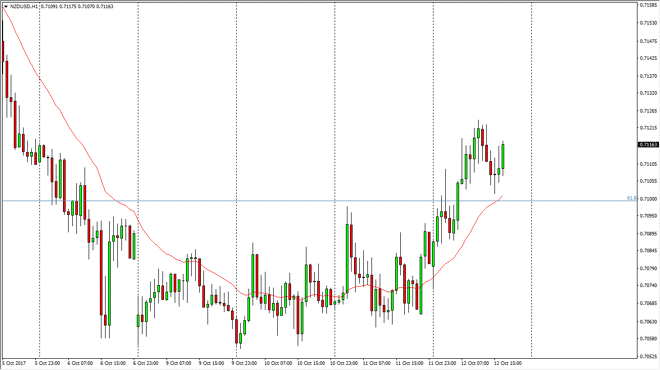

NZD/USD Forecast October 13, 2017, Technical Analysis

Updated: Oct 13, 2017, 05:40 GMT+00:00

The New Zealand dollar rallied a bit during the day on Thursday, and broke above the 0.71 barrier. By doing so, it looks like we are going to continue to

The New Zealand dollar rallied a bit during the day on Thursday, and broke above the 0.71 barrier. By doing so, it looks like we are going to continue to go to the upside, and the pull back to the 24-hour moving average which was at the 0.71 handle solidified that level as potential support. Ultimately, this is a market that I think continues to extend towards the 0.72 level above, and then perhaps the 0.75 level. The New Zealand dollar is of course a “risk on” currency, as the commodity markets and stock pricing highly influence it. The US dollar is the safety currency when it comes to this pair, and as long as there are animal spirits out there willing to take financial risk, the New Zealand dollar should do reasonably well.

I like buying pullbacks, and I think that the market will continue to find value every time we dip. The recent turnaround has been relatively impressive, suggesting that perhaps we are going to see this market climb significantly over the next several sessions. That’s not to say that there will be volatility, but I look at these pullbacks as buying opportunities, unless of course we can break down below the 0.71 level significantly. Even then, I think is going to be a certain amount of support near the 0.7060 level, where we had recently seen buyers trying to turn the market around. The New Zealand dollar does tend to be choppy, but these moves do tend to have a bit of follow-through, so keep that in mind. However, if we get negative headlines crossing the wires, even if it’s just geopolitical, that could work against the New Zealand dollar, at least for the short term. Volatility is normal, so expect it.

NZD/USD Video 13.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement