Advertisement

Advertisement

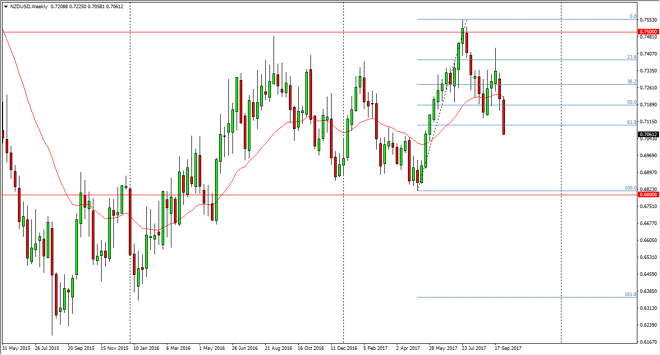

NZD/USD forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:29 GMT+00:00

The New Zealand dollar broke down significantly during the week, slicing through the 50% Fibonacci retracement level, and then broke down below the 61.8%

The New Zealand dollar broke down significantly during the week, slicing through the 50% Fibonacci retracement level, and then broke down below the 61.8% Fibonacci retracement level. It now looks likely to test the 0.70 level underneath, and the fact that we are closing towards the bottom of the range for the week, suggests that we are going to continue to go even lower. With this in mind, it would make sense to do an entire retrace of the uptrend, sending this market down to the 0.68 level below. With this in mind, the New Zealand dollar is one of the least liquid major currencies, so it’s likely that any move lower here would be rather rapid. A breakdown below the 0.68 level would be somewhat catastrophic, and send this market looking for much lower levels. In the meantime, I believe that waiting until we break down below the 0.70 level is probably the best way to go about shorting this market, and as far as buying is concerned it’s difficult to imagine doing so currently.

Remember that the New Zealand dollar is highly influenced by commodity markets in general, and their overall “attitude.” While they are directly affected by soft commodities, the New Zealand dollar is quite often used by currency traders as a proxy for the overall commodity trade. If commodity markets on the whole start to fall, that will only exacerbate this move, and send this market to much lower levels. Even if we did rally and break above the weekly candle, I still think there’s enough resistance above the keep this market on the back foot. The volatility continues, but longer-term traders certainly seem to be making up their minds as to the direction of the kiwi dollar.

NZD/USD Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement