Advertisement

Advertisement

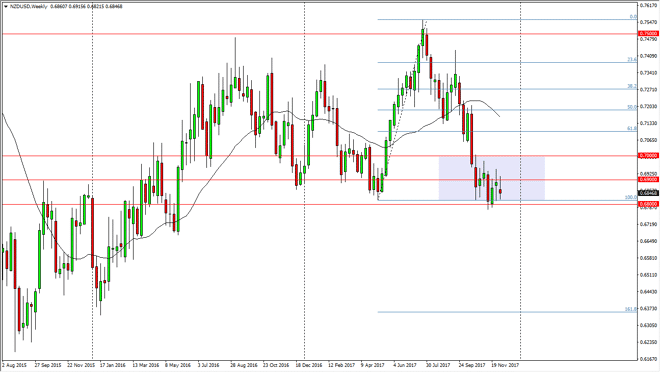

NZD/USD Price forecast for the week of December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:10 GMT+00:00

The kiwi dollar is currently pressing against the 0.68 level underneath, which is a major support level. A breakdown below there should send the market down to the 0.66 handle.

The New Zealand dollar had a choppy week, bouncing back and forth in multiple moves. At the end of the week though, we had formed a negative looking candle, and I believe we are trying to break down below the vital 0.68 handle. Once we do break down below that level, as I believe that the market is going to continue to go much lower, perhaps down to the 161.8% Fibonacci retracement level, which is closer to the 0.6375 handle. That’s not to say that is can be easy to get down there, and we most certainly will have the occasional bounce, but it appears to me that the relentless selling in this pair continues, and that rallies continue to offer selling opportunities. In fact, it’s not until we break above the 0.70 level that one can make the argument to go long of this pair for any significant amount of time.

With the significant amount of volatility, I think that patience might be needed, but I believe that we will eventually see the US dollar strength in. This will be especially true as it appears the Federal Reserve is ready to raise interest rates later this month. If we get a hockey statement, that should be enough to send this pair much lower. However, if the Federal Reserve surprises with more of a dovish stance, that could at the very least keep this market in this consolidated area, but could also even reverse things, but at this point my base case is for a lower move, but may need the catalyst of the Federal Reserve to make that happen. Beyond that, don’t forget that if commodities start to sell off, that is also negative for this currency pair.

NZD/USD Video 11.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement