Advertisement

Advertisement

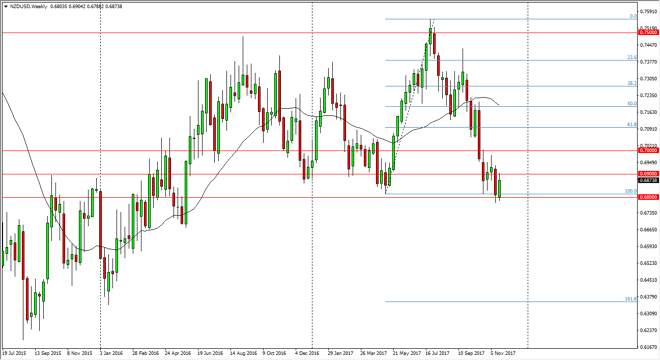

NZD/USD Price forecast for the week of November 27, 2017, Technical Analysis

Updated: Nov 25, 2017, 05:21 GMT+00:00

The New Zealand dollar had a positive week, using the 0.68 level as support. This is an area that has been supportive in the past, and the fact that we

The New Zealand dollar had a positive week, using the 0.68 level as support. This is an area that has been supportive in the past, and the fact that we bounced towards the 0.69 level was probably to be expected. However, the 0.69 level offered enough resistance to show significant bearish pressure on Friday, and I think this shows just how difficult it’s going to be to rally with any type of significance, and I believe that the 0.70 level above is going to be massive resistance. A breakdown below the 0.68 level, the market then goes looking towards the 161.8% Fibonacci retracement, which is close to the 0.6350 level.

The New Zealand dollar is very sensitive when it comes to the commodity markets in general, and of course risk appetite. I believe that the US dollar is falling for several different reasons, but the New Zealand dollar is a bit different than most currencies, as it isn’t as liquid, and of course there are a lot of people concerned about spending coming from the election of a Labour government. However, if we were to break above the 0.70 level, then I think the market goes back towards the top of the consolidation area, which is closer to the 0.75 handle. I think that we would need to see a significant break down in the US dollar to see that happen, and more than likely we are going to see a lot of choppiness, and indecision when it comes to the NZD/USD pair, as we have multiple issues pushing in both directions. Keep a small position, but start adding as soon as the market moves in your favor. In general, I believe in the bearish pressure, but the US dollar isn’t exactly healthy either.

NZD/USD Video 27.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement