Advertisement

Advertisement

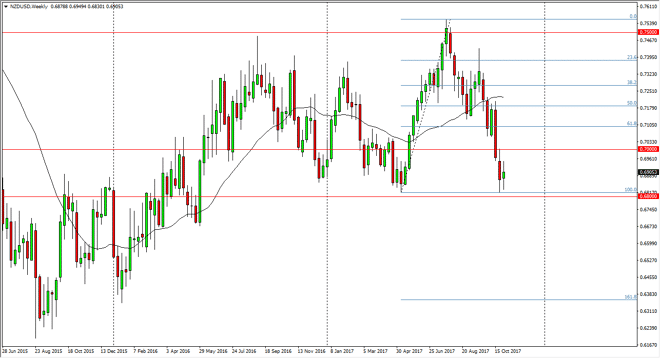

NZD/USD Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:12 GMT+00:00

The New Zealand dollar went back and forth during the week, as the 100% Fibonacci retracement level has offered support. The 0.68 level underneath is

The New Zealand dollar went back and forth during the week, as the 100% Fibonacci retracement level has offered support. The 0.68 level underneath is massively supportive as well, so I think it makes sense that we could get some upward pressure. But on the other hand, the 0.70 level above has been resistive, and I think that the market is likely to see a bit of consolidation in this area. A breakdown below the 0.68 handle sends this market down to the 0.65 handle, and perhaps even the 0.6375 level after that, as it is the 161.8% Fibonacci extension. Overall, I am bearish of the New Zealand dollar, but it’s likely that the market may have to rally a bit.

If we were to break above the 0.70 level, the market will probably go looking towards the 0.72 level, as it is the next cluster of support and resistance. Ultimately though, I think that there are too many risks out there to think that the New Zealand dollar will strengthen significantly. Ultimately, the Federal Reserve looking likely to raise interest rates should continue to push this market lower as well, especially in combination with the elections in New Zealand, should continue to be a main theme here.

In general, the market should continue to be noisy, so therefore think it may be easier to sell short-term rallies in this range. The market is likely to be very noisy, and that being the case you may wish to use a smaller than usual position. However, once we get out of this 200 pips range, it’s likely that we can build a larger position, especially if we go to the downside as it would be a complete capitulation of support.

NZD/USD Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement