Advertisement

Advertisement

Oil Hits Critical Support: Week Ahead Commodities Analysis – GLD, SLV, USO

Updated: Mar 5, 2019, 14:43 GMT+00:00

Oil prices are now trading at their lowest levels in more than a year, and moves like these are important given the fact that price trends in the

Oil prices are now trading at their lowest levels in more than a year, and moves like these are important given the fact that price trends in the September period will often dictate what is seen for the remainder of the year. Fundamentally, this announcement implies Saudi Arabia is less likely to reduce output so traders will need to monitor these areas in order to determine whether or not these price trends will be sustainable, according to recent market reports released by BestCredit.

Prices in Brent — the global benchmark — to have fallen to sub-$100 levels for the first time in 15 months. So far prices have failed to overcome this highly important psychological level. So going forward, commodities traders will need to look for evidence that Saudi Arabia and other OPEC countries is actually cutting its production in order to send market valuations back into triple-digit territory. This means that assets like the SPDR Gold Trust ETF (NYSE: GLD) and iShares Silver Trust ETF (NYSE: SLV) will likely show a positive correlation to moves seen in the United States Oil Fund LP ETF (NYSE: USO). Inverse correlations here would then be seen in the PowerShares DB US Dollar Index Bullish ETF (NYSE: UUP). Here, we look at the latest technical developments in gold, silver, and crude oil.

________________________________

SPDR Gold Trust ETF (NYSE: GLD)

Critical Resistance: 117.50

Critical Support: 115.80

Trading Bias: Watching for Bullish Rebound

(Chart Source: CornerTrader)

GLD / Gold Trading Strategy: GLD has seen a massive sell-off but wait for moves back into 117.50 resistance before entering into new short positions. This area offers better risk-reward ratio relative to current market pricing.

GLD has seen a massive sell-off lately but this increases the risk corrective pullbacks that are in line with the bullish direction. RSI is rising, this suggests we might have seen a bottom at 115.80 and it is relatively clear at this stage that most of the bearish majority has already made its presence felt. Longer term, the trend is still negative but we will need to see some retracement back toward the 100/200 average area before considering a new short position. Initial resistance can now be found at 117.50, so bears that are trading from a more aggressive stance can use this area to short the market and capitalize on better risk to reward scenarios. Alternatively, a clear break of the 117.50 area would indicate that a medium term bottom in place at 115.80.

_______________________________________

iShares Silver Trust ETF (NYSE: SLV)

Critical Resistance: 16.85

Critical Support: 16.20

Trading Bias: Sideways to Bullish

(Chart Source: CornerTrader)

SLV / Silver Trading Strategy: Upside risk outweighs downside potential, so traders should either play the current range or wait for a break of 16.85 resistance to initiate breakout buying strategies.

SLV has shown some differing price characteristics when compared to GLD in that its technical behavior is more range bound and dependant on clearly defined support and resistance breaks. The silver market have behaved in a much more “orderly fashion” and this creates great trading scenarios for those looking to implement range trading strategies (ie buying at support and selling at resistance). Short term, the first areas to watch here come in at 16.85 and 16.20, and we would expect these conditions to continue for at least as long as these support and resistance zones remain intact. The Daily RSI indicator is still in the sub-50 zone, so there is good scope for prices to rise if we start to see momentum buying on any breaks of resistance.

_______________________________________

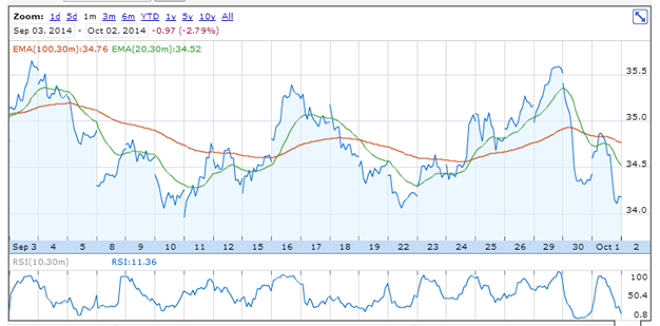

United States Oil Fund LP ETF (NYSE: USO)

Critical Resistance: 35.60

Critical Support: 34.10

Trading Bias: Bearish

(Chart Source: CornerTrader)

USO / Crude Oil Trading Strategy: Oil ETFs are still a sell on rallies. Wait for prices to retrace back to at least the mid-point of its recent range (upper 34s in USO) before selling these assets.

The USO ETF has seen some increased volatility in recent weeks, with price action unfolding in pronounced bullish and bearish waves. These wave have been contained with a definable range, however, so this creates some nice shorting scenarios if prices move back toward the mid-35s. The Daily RSI indicator is now heavily oversold , so there is clear risk for a corrective move to the topside which could catch bearish traders short if they are too late to the game. Much more prudent to set sell orders in the upper 34s or above.

About the Author

Advertisement