Advertisement

Advertisement

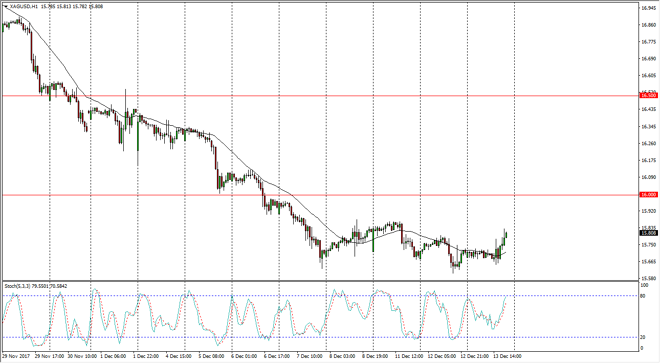

Silver Price Forecast December 14, 2017, Technical Analysis

Updated: Dec 14, 2017, 06:01 GMT+00:00

Silver markets continue to be very noisy, as the Federal Reserve is ready to release an interest rate statement, which of course will have a massive effect on the US dollar, thereby having a massive effect on this market.

Silver markets continue to be very noisy, but we are starting to find buyers. Longer-term, the $15 level looks to be very supportive, and therefore I think that we could see limited downside. I believe that if we roll over, I would be looking for value once things calm down. If we can break above the $16 level, it’s likely that we go much higher. A break above the $16 level probably will have the market looking for the $16.50 level above, and perhaps even higher than that. In general, the markets will continue to be thin, but I think that longer buy-and-hold type traders are going to do quite well in silver eventually. If the Federal Reserve looks dovish at all during the statement, this will send the Silver markets rocketing higher. I believe that we are starting to see the recognition that we are close to the bottom of the overall consolidated range, so I think the buyers are certainly starting to show up again.

That being said, if we were to break down below the $15 level on a daily close, that would be extraordinarily negative for silver, and would almost certainly involve a very positive story involving the US dollar. Because of the massive amount of leverage in the futures market, I prefer buying silver either in the CFD market, or better yet: physical silver as it gives us a way to play this market without leverage, and therefore it becomes more of an investment rather than a short-term trading opportunity.

SILVER Video 14.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement