Advertisement

Advertisement

Silver Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:02 GMT+00:00

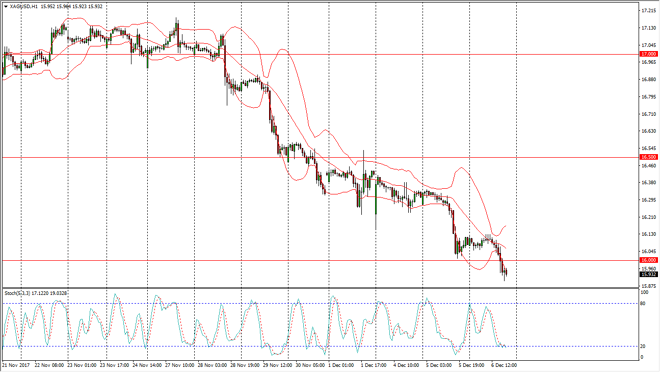

Silver markets went sideways initially during the trading session on Wednesday, but broke down below the $16 level. By doing so, I think we are going to see a continued selling pressure, but we are getting a little bit oversold on short-term charts.

Silver markets struggled a bit during the day on Thursday, initially going sideways but then breaking down below the $16 handle. That of course is a large, round, psychologically significant number, and I think that we will go looking towards the $15.50 level underneath, and then of course the large, round, psychologically important figure of $15. Looking at the hourly chart for a bounce or supportive candle might be an opportunity to wait for short-term volatility and exhaustion to start shorting again. If we were to break above the $16.20 level, then I think we probably go towards the $16.50 level.

Longer-term, I believe in buying the silver near the $15 level on signs of support for a longer-term “buy-and-hold” scenario. We will have to pay attention to the US dollar, because of a continues to strengthen that of course works against the value of precious metals in general. The Silver markets are more of a longer-term investment than anything else, but if you are a futures trader, be patient and wait for nice selling opportunities in the short term, only to turn around near the $15 level where we should see a lot of demand. A breakdown below the $15 level would change everything, perhaps crushing silver down to the $12.50 level. In general though, I believe that using low leverage in holding onto silver longer-term in the physical form is probably the best way to take advantage of what will eventually be a very strong bullish market.

SILVER Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement