Advertisement

Advertisement

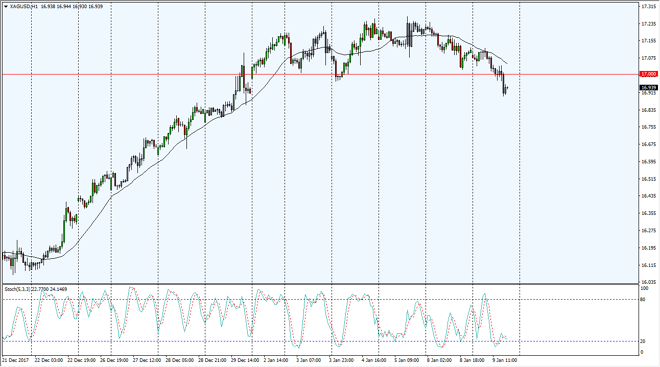

Silver Price Forecast January 10, 2018, Technical Analysis

Updated: Jan 10, 2018, 04:12 GMT+00:00

Silver markets drifted a little bit lower during the trading session on Tuesday, breaking below the vital $17 level. There is a gap that we are currently testing though, and that could give us an opportunity to find buyers in that general vicinity. Either way, the next couple of sessions could be vital.

Silver markets drifted a little bit lower during the trading session on Tuesday, as the US dollar has strengthened during the day. The market looks likely to continue to be volatile, and as we are testing a gap, we could find buyers. At this point, I still prefer the upside overall, but if we were to break down below the $16.80 level, that could change the outlook for the short term. I think that there are plenty of reasons to think that the buyers will try to drive back towards the $17.25 level, but Silver tends to be choppy under the best of circumstances, so this move is not surprising at all. I believe that the market is essentially reacting to whatever the US dollar does, as it is a way to preserve value if the dollar is dropping. Pay attention to the Forex markets in general, and if the USD is struggling, that should be reason enough for Silver to go higher.

It is completely possible that we get some type of bond from a geopolitical headline, as sometimes traders will consider precious metals overall, Silver included. If we can break above the $17.25 level, the market should then go to the $17.50 level. If we break down below the $16.80 level, the market probably goes down to the $16.50 level where I think there is even more support. In general, I like the idea of buying, but I also recognize that you should probably do so slowly is silver can be very dangerous.

SILVER Video 10.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement