Advertisement

Advertisement

Silver Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:16 GMT+00:00

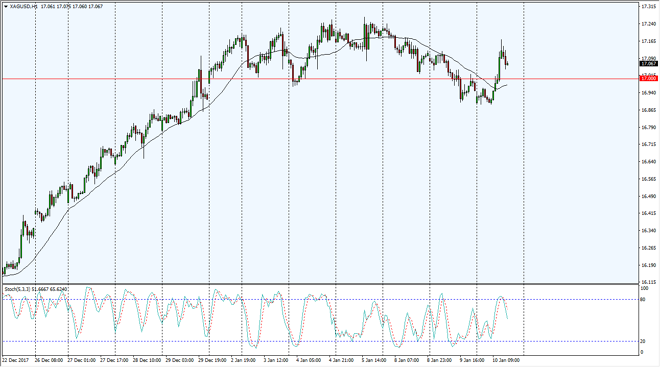

Silver markets initially gapped lower at the open on Wednesday, but then shot higher, breaking above the $17 level. This is a bullish sign, and I think that the market is trying to pick up where it had left off recently. Currently, it looks as if we are consolidating in general at this large, round, psychologically significant number, so caution is advised.

Silver markets gapped lower at the open on Wednesday, drifting down towards the $16.90 level, but we had seen quite a bit of bullish pressure, breaking above the $17 level rather handily as the Americans came aboard. I believe that we will probably see a short-term pullback, but that should offer value for traders to get involved in. I think that the $16.90 level underneath offers significant support, and I think that we will eventually go to the $17.25 level above, which has been massively resistive of the last couple of weeks. Eventually, we should break above there, and continue to go much higher, with the first target being the $17.50 level.

If we were to break down below the $16.90 level, the market probably goes down to the $16.75 level after that, which has been supportive, and that being the case it’s likely that we will find buyers underneath. I think it would represent value, and looking at the longer-term charts you can make an argument that we have been consolidating for a couple of years, but every time we drop, it seems like the buyers become a little bit more aggressive, as volatility continues to be an issue. Ultimately, I believe that Silver will go looking towards $20, but we may be taking a couple of years to get there. The US dollar of course has its influence on what happens in the silver market, as it tends to move in the opposite direction.

SILVER Video 11.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement