Advertisement

Advertisement

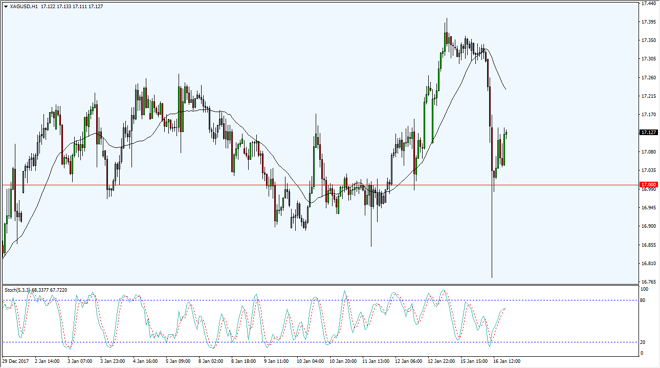

Silver Price Forecast January 17, 2018, Technical Analysis

Updated: Jan 17, 2018, 08:08 GMT+00:00

Silver markets fell apart during the trading session on Tuesday, as market participants came back from the Martin Luther King Jr. holiday. The market looks likely to respect the $17 level, considering that we had seen so much in the way of bullish pressure just underneath there.

The Silver markets continue to be very noisy, and although we broke down rather significantly during the trading session on Tuesday, but then turned around to show signs of bullish pressure again. The market looks likely to continue to be very loud, but I think that the US dollar continues to struggle overall, and that should provide a bit of a boost for silver. Judging by the massive reaction that we have seen over the last several hours, it’s likely that the participants will continue to look at dips as buying opportunities, and perhaps add a bit.

I believe that physical silver is probably the best way going forward, as there is much volatility. However, if you choose to use CFD markets, those can help mitigate some of the losses, because at this point, with this type of volatility I would be very leery of trading in actual futures markets, as the contracts can be rather expensive. The market should have an interest in reaching the top of the overall consolidation area, which is $18.50, going back well over a year. Until then, I think you are probably better off adding slowly on dips, as I believe longer-term we will eventually break out above the $18.50 handle, perhaps reaching towards the $20 level above. I believe that roughly every $.50, there are major support barriers underneath, so if you are cautious about the size of your trade, you can hang on through this type of noise, which unfortunately Silver is well known to have.

SILVER Video 17.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement